The Family Pension Scheme is a crucial social security benefit for government employees in India, established as a statutory right to ensure financial stability for the families of deceased civil servants.

This comprehensive guide, demystifies the complex Central Civil Services (CCS) Pension Rules, 2021. Here, we break down the detailed eligibility criteria for every dependent, explain the pension calculation with an interactive tool, and provide a clear roadmap for the entire claim process, empowering you to understand and secure your legal rights.

The Family Pension Scheme is a crucial social security benefit for government employees in India, established as a statutory right to ensure financial stability for the families of deceased civil servants. This comprehensive guide, updated for September 2025, demystifies the complex Central Civil Services (CCS) Pension Rules, 2021. Here, we break down the detailed eligibility criteria for every dependent, explain the pension calculation with an interactive tool, and provide a clear roadmap for the entire claim process, empowering you to understand and secure your legal rights.

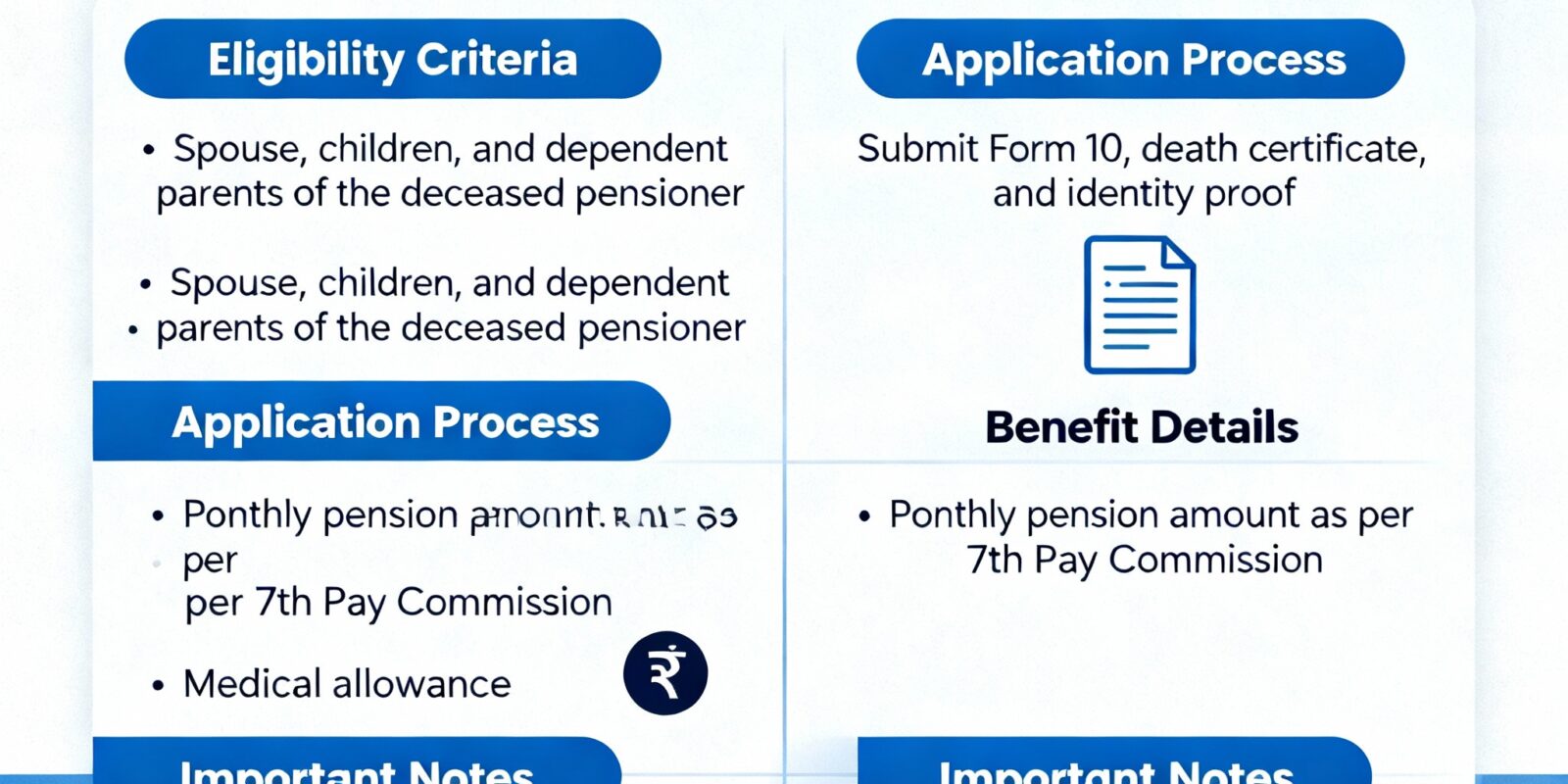

Family pension is a recurring monthly payment made to the eligible dependents of a government servant who dies while in service or after retirement. It's not a charitable grant but a right earned through the employee's service. Eligibility follows a strict hierarchy. The pension is offered to the first eligible person in line, and only passes to the next upon their ineligibility. The process begins with the Head of Office where the employee last served. They are responsible for initiating the paperwork upon receiving the death intimation. The Pay and Accounts Office (PAO) verifies the claim and service details, then calculates the pension amount and issues the Pension Payment Order (PPO). The eligible family member must submit the required application form along with documents like the death certificate, proof of relationship, and bank account details. The PPO is sent to the Central Pension Accounting Office (CPAO) and then to the authorized bank. The bank credits the pension to the claimant's account. The court clarified that a divorced daughter is eligible for family pension even if her divorce petition was pending at the time of her parent's death, provided the divorce is granted subsequently. This recognizes the daughter's dependency status from the date of filing for divorce. The court reaffirmed the sequential hierarchy, directing authorities to grant pension to dependent parents from the moment their daughter-in-law (the previous recipient) became ineligible due to remarriage. Family law intersects with service rules in complex ways. Here’s how the pension rules apply in some less common but critical situations. If a government servant disappears, the family isn't left without support: The validity of the marriage under personal law is paramount: Family pension is not tax-free. It is taxed under the head 'Income from Other Sources' in the hands of the recipient. However, a significant deduction is available, which reduces the tax burden. Under Section 57(iia) of the Income Tax Act, a standard deduction is allowed against the family pension received. The deductible amount is:

33.33% of the pension amount, OR ₹15,000

... whichever is lower. For instance, if the annual family pension is ₹1,80,000, one-third is ₹60,000. The deduction will be capped at ₹15,000. The taxable pension will be ₹1,65,000. Facing delays can be frustrating. The government has established mechanisms to address grievances related to pensions. Follow this escalation matrix if you are not getting a timely response. The first point of contact. Formally write to the office where the employee last served or the relevant Pay & Accounts Officer (PAO) to inquire about the status of your application. If you don't receive a satisfactory response, lodge a grievance on the Centralized Pension Grievances Redress and Monitoring System (CPENGRAMS). This is an online portal managed by the Department of Pension & Pensioners' Welfare. For legal disputes, such as wrongful rejection of a claim or interpretation of rules, the next step is to approach the appropriate judicial forum. The CAT is the specialized body for service matters, followed by the High Court. This article is for informational purposes only and does not constitute legal advice. Pension rules are subject to change. Always consult with a legal professional for advice specific to your situation. Evaakil.com is not liable for any actions taken based on this information.A Comprehensive Guide to Family Pension Rules in India

Defining "Family Pension"

Who is Eligible for Family Pension?

For the Surviving Spouse (Husband/Wife)

For Children

For Unmarried / Widowed / Divorced Daughters (Over 25)

For Dependent Parents

How is Family Pension Calculated?

Interactive Pension Estimator

Your Estimated Monthly Pension

The Step-by-Step Claim Process

Initiation of Claim

Verification by PAO

Submission of Documents

Disbursement by Bank

Landmark Legal Precedents

Supreme Court of India (February 2024)

Himachal Pradesh High Court (May 2025)

Navigating Special Scenarios & Complex Cases

Employee is Missing

Second Marriage Scenarios

Tax Implications of Family Pension

Standard Deduction

What To Do When Your Claim is Delayed or Rejected

Head of Office / PAO

CPENGRAMS Portal

Central Administrative Tribunal (CAT) / High Court

Frequently Asked Questions

Key Takeaways & Actionable Advice

For Families:

Disclaimer: