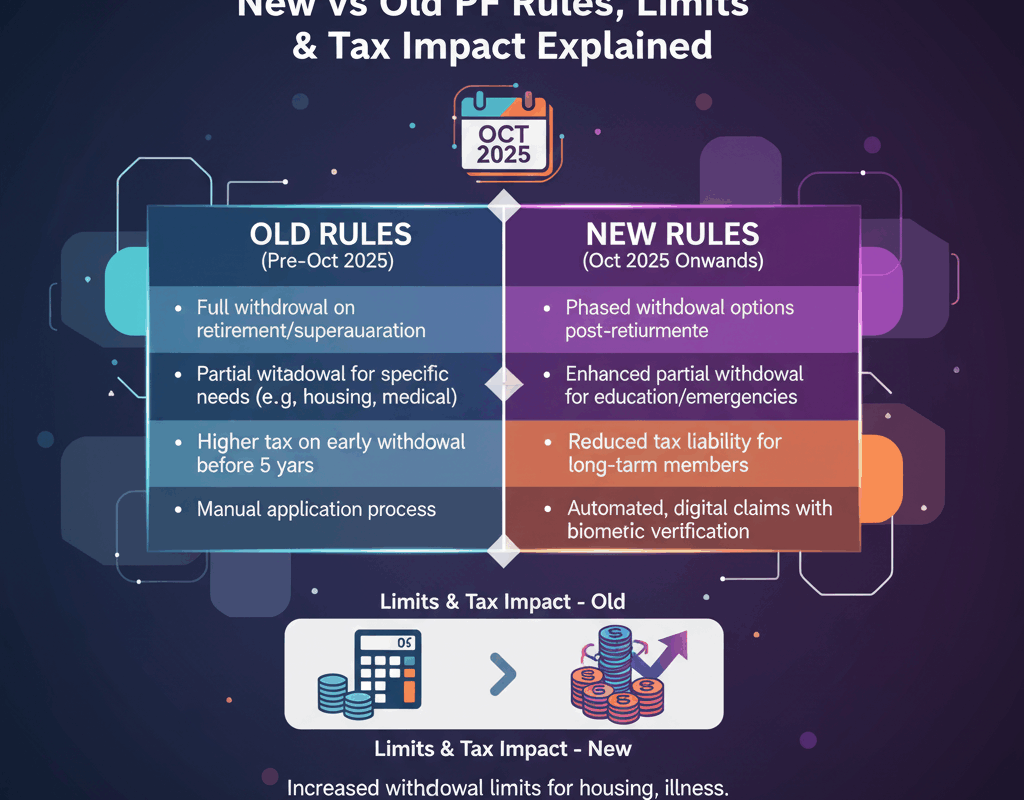

Starting in October 2025, the rules for withdrawing your Employees’ Provident Fund (EPF) are undergoing a monumental shift. The rigid, document-heavy process is being replaced by a flexible, self-declaration system designed for greater liquidity.

This guide provides a detailed breakdown of the new EPFO withdrawal rules versus the old regulations. We will explore the simplified withdrawal reasons, the increased advance limits (up to 75% of your corpus), the new 12-month service eligibility, and the critical tax implications you must understand before making a claim.

Whether you’re planning for a major life event or facing an emergency, learn how these changes affect your retirement savings and master the new instant, auto-settlement process on the UAN portal.

EPFO's New Rules (Oct 2025)

A radical shift in how you access your retirement savings. We break down the massive changes, from instant access for life's needs to new safeguards for your future.

Key Changes at a Glance

Simplified Categories

13+ complex reasons are now consolidated into 3 simple categories: Essential Needs, Housing, and Special Circumstances.

Greater Liquidity

Withdraw up to 75% of your total corpus (including employer's share), a massive increase in accessible funds.

25% Safety Net

A mandatory 25% minimum balance is now locked-in, ensuring a foundational corpus for your retirement.

Longer Wait on Exit

The waiting period for final settlement after unemployment is extended from 2 months to 12 months (PF) and 36 months (Pension).

Who is Affected by These Changes?

These new regulations apply to a vast majority of the formal workforce in India. You are covered if you are:

- A salaried employee contributing to an EPF account.

- Part of an 'exempted establishment' that manages its own PF trust.

- A subscriber to the National Pension System (NPS) only; these rules do not apply.

Timeline: The Shift to New Rules

Old Regime (Before Oct 2025)

Complex, multi-reason, document-heavy process. Lower liquidity.

New Regime (From Oct 2025)

Simplified, auto-settled, self-declared process with higher liquidity and a safety net.

Old Rules vs. New Rules: A Detailed Breakdown

Use the filters to explore changes for specific needs.

| Feature | Old Rules (Pre-Oct 2025) | New Rules (Post-Oct 2025) |

|---|---|---|

| Withdrawal Reasons | 13+ specific reasons (Para 68B, 68K, etc.) | 3 broad categories (Essential, Housing, Special) |

| Withdrawal Quantum | Limited, often only employee's share + interest. | Up to 75% of total corpus (incl. employer share). |

| Minimum Service | Varied: 5-7 years for major needs. | Standardized to just 12 months for all partial withdrawals. |

| Frequency (Marriage/Edu) | Lifetime limit of 3 withdrawals combined. | Up to 10 for education, 5 for marriage. |

| Housing Advance | Up to 90% of total corpus after 5 years service. | Up to 75% of total corpus after 12 months service. |

| PF Final Settlement | Full withdrawal after 2 months of unemployment. | 75% immediately, final 25% after 12 months. |

| Pension (EPS) Withdrawal | Full withdrawal after 2 months of unemployment. | Waiting period extended to 36 months. |

| Documentation | Required proofs (medical bills, admission letters). | Zero documentation, based on self-declaration. |

| Claim Settlement | Manual verification, often took weeks. | 100% auto-settlement for partial claims, often instant. |

Your Step-by-Step Guide to the New Withdrawal Process

Login & KYC Check

Log in to the UAN Member Portal. Ensure your KYC (Aadhaar, PAN, Bank) is complete and verified.

Initiate Claim

Go to 'Online Services' > 'Claim (Form-31)'. Verify your bank account details.

Self-Declare & Submit

Select your reason from the new simplified categories, enter the amount, and submit using Aadhaar OTP.

Instant Auto-Settlement

For most partial claims, the process is now 100% automated. Expect the funds in your bank account within hours, not weeks.

Visualizing the Impact: Interactive Scenarios

How Much More Can You Access?

See the difference in accessible funds for a major life event. Adjust the total PF balance to see the impact.

Long-Term Retirement Corpus

Frequent withdrawals can significantly impact your final nest egg. This chart projects growth over 30 years with a starting salary.

Critical Alert: The Hidden Tax Trap

The new rules create a major disconnect with income tax laws. While you can now withdraw funds after just 12 months of service under EPFO rules, these withdrawals are fully taxable if you have less than 5 years of continuous service.

- Withdrawals before 5 years of service are added to your income and taxed at your slab rate.

- If the amount is over ₹50,000, TDS at 10% will be deducted.

- The old rules naturally protected you, as eligibility (5-7 years) often aligned with the tax-free period. This protection is now gone.

Strategic Withdrawal: A Double-Edged Sword

The Upside: Financial Flexibility

- Crucial liquidity for emergencies like medical crises.

- Fund major life goals (education, home down payment) without taking high-interest loans.

- Reduces reliance on credit cards or personal loans during financial distress.

The Downside: Retirement Risk

- Significant loss of the power of compounding. Every rupee withdrawn is a rupee not growing tax-free.

- Risk of treating your PF as a casual savings account, depleting your long-term corpus for non-essential spends.

- Major tax implications if withdrawn before 5 years of service, regardless of the new EPFO rules.

The 'Why' Behind the Overhaul

Balancing Act: Liquidity vs. Long-Term Security

The government aims to transform the EPF from a rigid, locked-in fund into a flexible financial tool for life's major milestones. The challenge was doing this without completely depleting retirement savings. Alarming data showed 87% of members had less than ₹1 lakh at final settlement. The new rules are a direct response to this.

The 25% "Golden Nest Egg" Mandate

This is the core safeguard. By locking 25% of the corpus, the policy ensures a minimum retirement fund remains untouched, benefiting from high, compounding interest and providing a social security floor.

Discouraging Premature Exits

Extending the final settlement waiting period to 12 months (PF) and 36 months (Pension) is a strategic move. It makes closing your account between jobs unattractive, nudging you to transfer your balance instead—a process now fully automated by EPFO 3.0. This is crucial for keeping members in the pension scheme long enough to qualify for a lifelong pension.