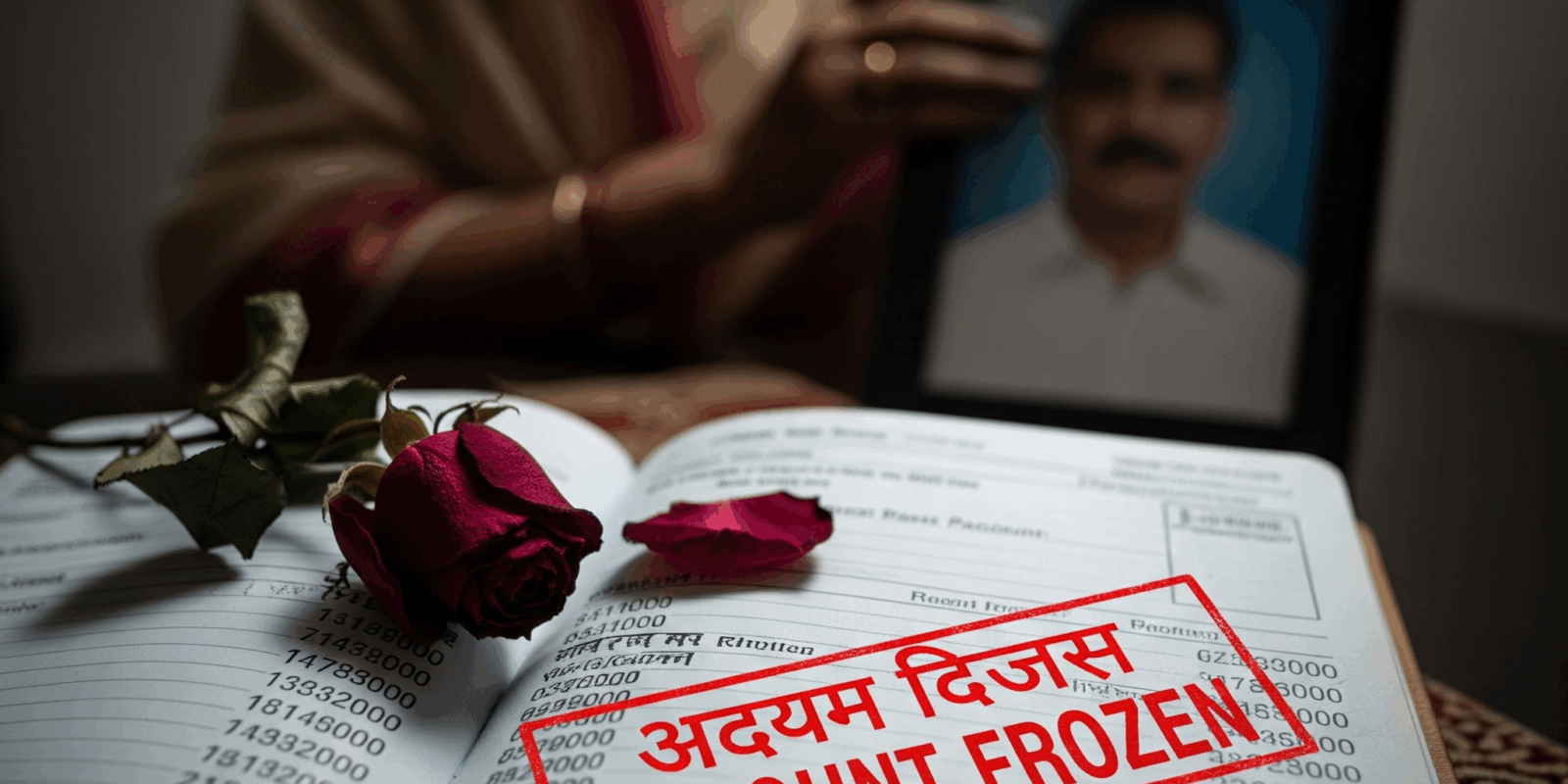

The death of a spouse is an incredibly difficult time, made even more stressful when financial institutions take improper action. A frequent and distressing issue for many families in India is having a bank freeze the surviving spouse’s personal account to recover a loan taken solely by the deceased. If you’re facing this situation, it is crucial to know your legal rights. This guide provides a detailed breakdown of the legal framework, the latest RBI guidelines for 2025, and the precise steps to take to unfreeze your account and seek remedies for this unlawful action.

Can a Bank Freeze Your Account for Your Deceased Spouse’s Loan?

A deep dive into Indian law, RBI rules, and your fundamental rights during a difficult time.

A Common Fear in a Difficult Time

The loss of a spouse is a period of profound emotional and financial turmoil. Navigating grief is a challenge in itself, and the last thing a family needs is to face aggressive demands from financial institutions. Yet, a common and deeply distressing situation arises when a bank, seeking to recover a loan taken by the deceased, takes the drastic step of freezing the surviving spouse's separate bank account.

The short answer, supported by Indian law, is NO.

A bank has no legal authority to unilaterally freeze or seize funds from a surviving spouse's personal account for a debt that was exclusively the deceased's responsibility. This report is your guide to understanding and defending your rights.

This comprehensive analysis will deconstruct the legal framework, detail RBI guidelines, examine landmark court cases, and provide a clear, step-by-step action plan for what to do if a bank acts unlawfully.

Table of Contents

- Interactive Liability Checker

- Key Legal Terms Explained

- The Legal Framework: Understanding Liability

- The Role of the Nominee: A Common Misconception

- RBI Guidelines and the Fair Practices Code

- Immediate Action Steps When Your Account is Frozen

- Sample Complaint Letter Format

- Your Step-by-Step Action Flowchart

- Remedy and Escalation: Fighting the Freeze

- Landmark Judgments and Case Studies

- Common Mistakes to Avoid

- When to Contact a Lawyer

- Prevention and Proactive Financial Planning

- Frequently Asked Questions (FAQ)

Interactive: Check Your Liability in 60 Seconds

1. Did you sign the loan agreement as a "co-borrower" or "co-applicant"?

Key Legal Terms Explained

Understanding these terms is the first step to confidently asserting your rights. Here are simple definitions for the concepts you'll encounter.

Estate

This refers to all the money and property owned by a particular person, especially at death. A bank's claim is against the deceased's estate, not the family's personal assets.

Legal Heir

An individual who is entitled to inherit the property of the deceased person under the law. Liability of a legal heir is limited to the value of the assets they inherit.

Guarantor

A person who contractually agrees to pay another's debt if the original borrower fails to pay. A guarantor is personally liable.

Lien

A right to keep possession of property belonging to another person until a debt owed by that person is discharged. Crucially, it applies only to the debtor's property.

The Legal Framework: Understanding Liability

The foundation of a surviving spouse's protection lies in a clear legal framework: debt is tied to the individual and does not automatically pass to family members. A lender's right to recovery is directed at the "estate of the deceased," not the heirs personally.

Liability is Limited to the Deceased's Estate

The liability of legal heirs is strictly limited to the value of the assets they inherit from the deceased's estate. If the outstanding loan is ₹5 lakh but the inherited estate is only worth ₹3 lakh, the lender can only claim up to ₹3 lakh. Your personal, separate assets are protected by a legal firewall.

The Critical Exceptions: When a Spouse IS Liable

While the general rule provides significant protection, liability arises from contractual obligations you voluntarily entered into. The table below clarifies these scenarios.

| Scenario | Who is Primarily Liable? | Extent of Spouse's Personal Liability |

|---|---|---|

| Unsecured Loan (Sole Borrower) | 1. Loan Insurance (if any) 2. Deceased's Estate |

Zero personal liability. Liability is limited to the value of inherited assets. |

| Unsecured Loan (Spouse as Co-borrower) | The surviving spouse. | 100% of the outstanding loan. You are personally liable. |

| Unsecured Loan (Spouse as Guarantor) | The surviving spouse (if estate is insufficient). | Up to the full outstanding amount. Your personal assets can be used. |

| Secured Loan (e.g., Home/Car Loan) | 1. The secured asset itself 2. Co-borrower/Guarantor 3. Deceased's Estate |

Zero personal liability. The bank can repossess the asset. |

The Principle of Mutuality: Your Ultimate Legal Shield

What is Mutuality?

This core legal principle states that for a bank to set off a debt, the debts must be between the **same parties** in the **same capacity**. A bank cannot settle a debt owed by your deceased spouse (Party A) using the money it owes to you in your separate account (Party B). This lack of mutuality makes freezing your account legally impermissible.

The Role of the Nominee: A Common Misconception

It is critical to understand the legal position of a nominee. Naming someone as a nominee in a bank account, fixed deposit, or insurance policy is often misunderstood as making them the owner.

A Nominee is a Trustee, Not an Owner

The Supreme Court of India has repeatedly clarified that a nominee is merely a custodian or trustee of the deceased's assets. The nominee's role is to receive the assets from the institution and hold them in trust for the legal heirs. The legal heirs, as determined by succession law or a Will, are the true owners.

Therefore, being a nominee on your spouse's account does not make you liable for their debts. The money you receive as a nominee becomes part of the deceased's estate, which the bank can then make a claim against through proper legal channels.

RBI Guidelines and the Fair Practices Code

The Reserve Bank of India (RBI) governs how banks must conduct themselves, ensuring fairness, transparency, and humane treatment, especially in sensitive matters like loan recovery.

Recovery Agent Rules

- Contact only between 7 AM and 7 PM.

- No abusive language, threats, or harassment.

- Must carry proper bank authorization.

- Must respect your privacy and dignity.

Deceased Depositors' Accounts

RBI's focus is on speedy and hassle-free settlement of claims to legal heirs. A bank's action of freezing an account contradicts these customer-centric regulations.

Immediate Action Steps When Your Account is Frozen

Discovering a freeze on your account can be shocking. It's crucial to act swiftly, calmly, and methodically. Your first communications with the bank should be in writing to create a clear paper trail.

Visit the Branch Immediately

Speak with the Branch Manager. While verbal communication is a starting point, do not rely on it. The primary goal of this visit is to identify the issue and state your intent to formally dispute it.

Demand an Explanation in Writing

Insist that the bank provide a formal letter explaining the legal basis for freezing your account. This document, often called a "lien marking letter," is critical evidence. Banks are obligated to provide this.

Submit a Formal Letter to the Bank

Draft a letter (sent via registered post for proof of delivery) addressed to the Branch Manager. Your letter should clearly state your case, reference legal principles, and demand immediate action.

Sample Complaint Letter Format

Use this template as a guide for your formal written complaint. Send it via Registered Post A.D. (Acknowledgement Due) to create a legal record of delivery. Be sure to replace the bracketed information with your specific details.

[Your Full Name]

[Your Full Address]

[Your Phone Number]

[Your Email Address]

[Date]

To,

The Branch Manager,

[Bank Name]

[Branch Address]

Subject: Unlawful Freezing of Savings Account No. [Your Account Number] - Request for Immediate Reversal

Dear Sir/Madam,

I am writing to formally protest the unlawful freezing of my personal savings account, number [Your Account Number], held at your branch. I was informed of this action on [Date you found out], which has caused me significant financial distress and hardship.

I understand this action has been taken in connection with the outstanding loan account number [Deceased's Loan Account Number], which was held solely in the name of my late spouse, [Deceased Spouse's Full Name], who passed away on [Date of Death].

I wish to state the following for the record:

- I am not a co-borrower, co-applicant, or guarantor for the aforementioned loan. My signature does not appear on any of the loan documentation in any capacity of liability.This is your core defense. State it clearly.

- The funds in my savings account are my personal assets and are entirely separate from the estate of my late spouse.Highlights that your account is not part of the deceased's estate.

- As per established Indian banking law and the legal Principle of Mutuality, a bank cannot set off a debt owed by one individual (my late spouse) against the funds held in the personal account of another, separate individual (myself). The required mutuality of parties does not exist in this case.Citing the specific legal principle shows you are well-informed.

This unilateral action of freezing my account is a violation of the Reserve Bank of India's Fair Practices Code and my rights as a customer.

Therefore, I demand that you immediately and unconditionally unfreeze my account and remove any lien or hold placed upon it within three (3) working days of receiving this letter.Set a reasonable but firm deadline for action.

Failure to comply will leave me with no alternative but to escalate this matter to the Banking Ombudsman through the RBI's Complaint Management System and pursue further legal action for financial damages and mental anguish caused by your bank's illegal actions.Clearly states the consequences of inaction.

Thank you for your prompt attention to this urgent matter.

Sincerely,

[Your Signature]

[Your Typed Full Name]

Enclosures:

1. Copy of my Aadhaar/PAN Card

2. Copy of my spouse's Death Certificate

Your Step-by-Step Action Flowchart

Feeling overwhelmed? This flowchart simplifies the process, showing you exactly which path to take at each stage of the escalation process.

Remedy and Escalation: Fighting an Illegal Account Freeze

If a bank has illegally frozen your account, do not feel intimidated. Follow this structured escalation process to seek redressal.

Formal Complaint to Bank

Submit a written complaint to the Branch Manager and Nodal Officer. Clearly state the lack of mutuality and demand immediate removal of the freeze.

Banking Ombudsman

If unresolved in 30 days, file a complaint on the RBI's CMS Portal (cms.rbi.org.in). This is a free and powerful mechanism.

Legal Recourse

As a final step, send a Legal Notice through a lawyer, followed by a civil suit to claim damages for financial loss and mental anguish.

Landmark Judgments: How Indian Courts Protect Families

Anumati vs. Punjab National Bank (Supreme Court)

"The cornerstone case. The SC protected a non-consenting joint account holder. The implication is clear: if a joint account is protected, a completely separate individual account has absolute protection."

Syndicate Bank vs. Vijay Kumar (Supreme Court)

"This case affirmed the banker's lien but clarified its proper application: it can only be used against the assets of the actual debtor, under a clear agreement, not a third party."

Punjab National Bank Ltd. vs. Arura Mal Durga Das (P&H High Court)

"A foundational case establishing that for a set-off to be valid, debts 'must mutually exist between the same parties.' This powerfully supports a surviving spouse's case."

Case Study: The Ordeal of Mrs. Sharma

After her husband's sudden demise, Mrs. Sharma, a retired schoolteacher, found her pension account frozen. The bank claimed it was to recover her husband's outstanding ₹2 lakh personal loan. Mrs. Sharma had never signed any loan documents.

Action Taken:

- She followed the steps outlined above, sending a formal letter citing the lack of mutuality.

- The bank did not respond within 30 days.

- She filed a complaint with the Banking Ombudsman through the RBI CMS portal, attaching the bank letter and her correspondence.

Resolution:

The Ombudsman's office intervened. Faced with regulatory pressure and a clear violation of legal principles, the bank immediately unfroze her account and issued a formal apology. This real-world scenario highlights the effectiveness of the grievance redressal mechanism.

Common Mistakes to Avoid

In a stressful situation, it's easy to make errors that can weaken your position. Be mindful to avoid these common pitfalls.

Making Verbal Promises

Never verbally agree to "settle" or "take care of" the loan. Any admission of liability, even if made under duress, can be used against you. Keep all communication formal and written.

Signing Unread Documents

Bank officials might pressure you to sign forms or documents. Do not sign anything without reading it thoroughly and, if possible, consulting a lawyer. You could inadvertently be agreeing to take on the debt.

Delaying Action

Time is of the essence. A frozen account can disrupt your ability to pay bills and manage daily expenses. Begin the formal complaint process immediately after discovering the freeze.

Not Keeping Records

Keep copies of all correspondence, postal receipts, and note down the names, dates, and times of every interaction with the bank. This documentation is vital evidence for your complaint to the Ombudsman.

When to Contact a Lawyer

While the Ombudsman process is designed to be user-friendly, certain situations warrant professional legal assistance.

You should consider hiring a lawyer if:

- The bank refuses to provide a written explanation for the account freeze.

- The loan amount is very large, making the stakes significantly higher.

- The bank is ignoring the directives of the Banking Ombudsman.

- You wish to sue the bank for damages due to financial loss or harassment.

- The loan documents are complex, or you suspect your signature may have been forged or misused.

A lawyer can send a formal Legal Notice, which often prompts a much faster response from the bank's head office, and can represent you in court if necessary.

Prevention is Better Than Cure

Proactive financial planning can prevent such distressing situations. Open communication and prudent financial management between spouses are the best safeguards.

Loan Protection Insurance

Consider a credit life insurance policy. It pays off the loan upon the borrower's demise, protecting the family from liability.

Clarity in Documentation

Never sign as a co-applicant or guarantor without fully understanding the "joint and several liability" implications.

Comprehensive Estate Planning

Create a valid Will, appoint nominees for all financial assets, and keep records consolidated and accessible.

Essential Documentation Checklist

Maintain a secure file containing the following documents for both spouses to ensure the surviving family can act efficiently:

- Will & Testament

- All Insurance Policies (Life, Health, Loan)

- Bank Account Details (with Nominees)

- Investment Statements (Stocks, Mutual Funds)

- Property Deeds and Documents

- Loan Agreements

- Aadhaar Card, PAN Card

- Birth & Marriage Certificates

Frequently Asked Questions (FAQ)

What if the account was a joint account?

If it's a joint account with an "Either or Survivor" mandate, the surviving spouse can typically operate the account. However, if the deceased had a loan with the same bank, the bank might exercise its right of set-off against the balance in the joint account, but only to the extent of the deceased's contribution. This is a legally complex area where consulting a lawyer is advised.

Can the bank take my deceased spouse's PF or gratuity?

No. Under Indian law, terminal benefits like Provident Fund (PF) and gratuity are protected from attachment by lenders or court orders. These funds are meant for the welfare of the employee's family and must be passed on to the legal nominee or heir.

What happens to a home loan after the primary borrower's death?

For secured loans like home loans, the liability rests on the co-borrower, if any. If there is no co-borrower, the legal heirs have the option to repay the loan and retain the property. If they are unable to pay, the bank can enforce its security interest and repossess the property through the legal process outlined in the SARFAESI Act, but it cannot go after the heirs' separate personal assets.

Do I need a lawyer to file a complaint with the Banking Ombudsman?

No, you do not need a lawyer. The Banking Ombudsman scheme is designed to be a free, accessible, and direct grievance redressal mechanism for bank customers. You can file the complaint yourself online through the RBI's Complaint Management System (CMS) portal.

Know Your Rights, Protect Your Finances

When faced with an unlawful action from a bank, remember that the law provides a formidable shield. You are not personally liable for your deceased spouse's sole-name loan, and your separate account is protected. Stand firm, communicate formally, and do not hesitate to use the established escalation path.

About the Author

The Evaakil.com Legal Team

The legal experts at Evaakil.com are dedicated to demystifying Indian law for the common person. With decades of combined experience in banking, family, and consumer protection law, our team provides meticulously researched, actionable insights to empower you to defend your rights.