Car Scratch Insurance Claim in India: When to File FIR, Protect NCB & Avoid Rejection

A deep scratch on your car is frustrating, but making the wrong insurance decision in India can cost you thousands more than the repair itself. Claiming for what seems like minor damage can lead to a huge loss of your No Claim Bonus (NCB), turning a ₹5,000 repair into a ₹25,000 mistake over time.

This comprehensive guide is designed to help you navigate this complex choice. We’ll break down the real cost of an insurance claim versus paying out-of-pocket, explain when filing a police complaint (FIR) for vandalism is legally essential, and provide the tools you need to make the best financial decision for your situation.

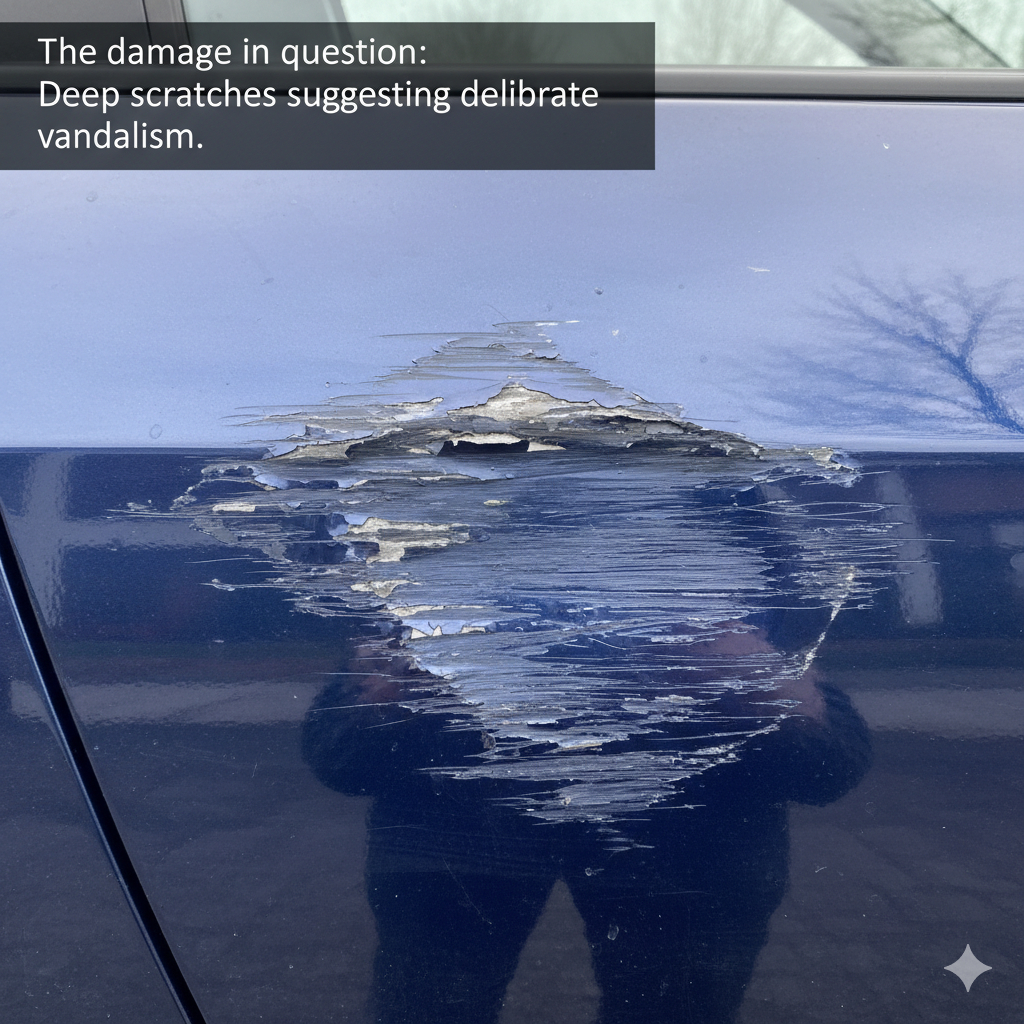

A deep scratch on your car is frustrating. But making the wrong insurance decision can cost you thousands more than the repair. This guide helps you make the financially sound choice in India. The damage in question: Deep scratches suggesting deliberate vandalism.

You have comprehensive insurance for moments like this. But is filing a claim always the right move? The answer, surprisingly, is often no. Indian motor insurance policies are structured with penalties—like losing your No Claim Bonus (NCB)—that can make claiming for minor damages a major financial mistake. This guide breaks down the real cost of a claim versus an out-of-pocket repair.

Not all scratches are equal. The depth of the scratch determines the repair cost and complexity. Run your fingernail gently over the scratch to gauge its depth. Fingernail Test: Your nail doesn't catch. Cost: ₹500 - ₹2,000 Fingernail Test: Your nail catches slightly. Cost: ₹3,000 - ₹8,000 per panel Fingernail Test: Your nail catches firmly. Cost: > ₹8,000 per panel Before you even think about calling your insurer, understand the two key financial levers they use: your No Claim Bonus and Deductibles. Think of your NCB as a reward for being a safe driver. It's a discount on your "Own Damage" premium that grows each year you don't make a claim. But make one claim, and this valuable asset resets to zero. This bonus is tied to you, not your car. You can transfer it when you buy a new vehicle, making it crucial to protect. This is the fixed amount you must pay out-of-pocket for any claim. Your insurer only pays the amount *above* this deductible. It's the first financial hurdle. Set by IRDAI. Typically ₹1,000 (up to 1500cc) or ₹2,000 (above 1500cc). An extra amount you chose when buying the policy to lower your premium. Total Immediate Cost = Compulsory + Voluntary Deductible Enter your policy details to see the hidden 5-year financial impact of losing your NCB. The damage on your car isn't just an accident; it's likely a criminal act of "mischief." Understanding when a police complaint is necessary is key to a successful insurance claim. e.g., Hit a pillar while parking e.g., Vehicle stolen, third-party injury e.g., Someone keyed the car deliberately Why is an FIR essential for vandalism? Insurers require it as proof that the damage wasn't your fault or an attempt at fraud. Without an FIR for a criminal act like vandalism (defined as "Mischief" under IPC Section 427), your insurer has a strong reason to reject your claim. The act of deliberately scratching a car isn't just vandalism; it's a specific crime in India. "Whoever commits mischief and thereby causes loss or damage to the amount of fifty rupees or upwards, shall be punished with imprisonment of either description for a term which may extend to two years, or with fine, or with both." In simple terms, if someone intentionally causes damage to your property (your car) worth more than ₹50, they have committed a punishable offense. Filing an FIR officially reports this crime and creates a legal record, which is why your insurer insists on it to process the claim. Use these templates to file a clear and effective police complaint. Present this written complaint at the police station to initiate the FIR process. If you've decided to file a claim, follow these steps precisely to ensure a smooth process. Call your insurer's toll-free number within 24-48 hours of discovering the damage. Any delay can be a reason for claim rejection. Do NOT move the car from the spot if it was a major accident. As determined in Part II, if the damage is due to vandalism, theft, or a third-party accident, go to the nearest police station with our template and get a copy of the FIR. The insurance company will appoint a surveyor who inspects the vehicle to assess the extent of the damage and estimate the repair cost. Be truthful and provide all details. Submit required documents: RC, driving license, policy copy, and FIR copy. Cashless: Take the car to a network garage. The insurer pays the garage directly. You only pay the deductibles and depreciation costs (if any). Answer a few simple questions to get a clear, data-driven recommendation on whether to claim insurance or pay for the repairs yourself. Your personalized recommendation will appear here. At your next renewal, consider these add-ons to avoid this dilemma in the future. This is the single best investment you can make. It allows you to make a claim (usually one per policy year) without your NCB resetting to zero. This add-on essentially pays for itself by protecting your future discounts. In a standard claim, the insurer deducts a percentage for depreciation (wear and tear) on parts like plastic and rubber. This add-on ensures the insurer pays the full cost of new parts, leaving you to pay only the deductible. Even with a valid issue, simple mistakes can lead to your claim being denied. Failing to inform your insurer within the stipulated time (usually 24-72 hours) is the most common reason for rejection. Always call them first. Ensure your policy hasn't lapsed. Damage that occurs even one day after your policy expires is not covered. Renew on time, every time. Misrepresenting how the damage occurred (e.g., claiming vandalism for a self-inflicted scratch) is fraud and will lead to immediate rejection and potential legal action.Car Scratched? Don't Get Penalized for Claiming.

The ₹5,000 Repair that Could Cost You ₹25,000

First, Identify the Damage Severity

1. Clear Coat Scratch

The shallowest layer. Often looks like a faint white line. Can usually be polished or buffed out with a DIY kit.2. Paint/Primer Scratch

Has gone through the clear coat to the colour layer or primer beneath. Needs professional touch-up and repainting.3. Deep to Metal Scratch

You can see the bare silver metal. Requires immediate professional repair to prevent rust, involving multiple layers of work.The Financial Calculus of an Insurance Claim

The No Claim Bonus (NCB): Your Financial Asset

Deductibles: Your Share of the Cost

Compulsory Deductible

Voluntary Deductible

Interactive Calculator: The True Cost of Your Claim

The Legal Pathway: To File an FIR or Not?

Interactive Guide: Do I Need an FIR for My Insurance Claim?

START: What caused the damage?

My Own Fault / Minor Scrape

Theft or Major Accident

Vandalism / Malicious Mischief

Understanding the Law: What is "Mischief"?

Indian Penal Code, Section 427: Mischief causing damage to the amount of fifty rupees.

FIR Format Templates

To,

The Officer-in-Charge,

[Name of Police Station],

[Address of Police Station],

[City, State, PIN Code].

Date: September 26, 2025

Subject: Complaint regarding malicious mischief and damage to my vehicle (Registration No: [Your Car's Reg. No.]) under IPC Section 427.

Respected Sir/Madam,

I, [Your Full Name], son/daughter of [Your Father's Name], residing at [Your Full Address], wish to report an incident of vandalism against my vehicle.

1. I am the lawful owner of a [Car Make and Model], colour [Car Colour], bearing the registration number [Your Car's Reg. No.].

2. On [Date of Incident], at approximately [Time of Incident, e.g., between 8:00 PM and 9:00 PM], I had parked my vehicle at [Exact Location where car was parked].

3. When I returned to my vehicle at [Time of Discovery], I was shocked to discover that it had been deliberately damaged. There are several deep scratches on the [mention parts, e.g., boot, driver-side door, bonnet], which appear to have been made with a sharp object with the intent to cause wrongful loss and damage.

4. The estimated cost of repairs for this damage is significant. This act of vandalism constitutes an offence of "Mischief" under Section 427 of the Indian Penal Code.

I have attached photographs of the damage as evidence. I request you to kindly register a First Information Report (FIR) for this criminal act and take necessary legal action against the unknown person(s) responsible. An FIR is also a mandatory requirement for my car insurance claim process.

Thank you for your prompt attention to this matter.

Yours faithfully,

(Signature)

[Your Full Name]

[Your Phone Number]

[Your Email Address]

To,

The Officer-in-Charge,

[Name of Police Station],

[Address of Police Station],

[City, State, PIN Code].

Date: September 26, 2025

Subject: Complaint regarding [Theft of Vehicle / Major Accident involving my vehicle] (Registration No: [Your Car's Reg. No.]).

Respected Sir/Madam,

I, [Your Full Name], son/daughter of [Your Father's Name], residing at [Your Full Address], wish to report a case of [theft of my vehicle / a major road accident involving my vehicle].

1. I am the lawful owner of a [Car Make and Model], colour [Car Colour], bearing the registration number [Your Car's Reg. No.]. Key identification details are: Engine No: [Engine No.], Chassis No: [Chassis No.].

**[SECTION A: FOR THEFT - Use this section if your car was stolen]**

2. I had parked my vehicle at [Exact Location where car was last seen] on [Date] at approximately [Time].

3. When I returned at [Time of Discovery], I found my vehicle was missing. I have searched the vicinity and inquired with locals to no avail. The vehicle has been stolen.

4. I request you to register an FIR for theft under IPC Section 379 and broadcast a wireless message to trace the vehicle.

**[SECTION B: FOR MAJOR ACCIDENT - Use this section for an accident]**

2. On [Date of Accident] at approximately [Time], while I was driving my vehicle at [Location of Accident], it was involved in an accident with another vehicle, a [Other Vehicle's Make/Model], with registration number [Other Vehicle's Reg. No.].

3. The accident was caused due to [Describe the cause, e.g., the other driver's rash and negligent driving, breaking a traffic signal, etc.].

4. As a result of this collision, there has been significant damage to my vehicle, and [mention any injuries to persons, if applicable].

5. I request you to register an FIR under the relevant sections of the IPC and Motor Vehicles Act.

An FIR is a mandatory requirement for my car insurance claim process. Please provide me with a copy of the registered FIR at the earliest.

Thank you.

Yours faithfully,

(Signature)

[Your Full Name]

[Your Phone Number]

[Your Email Address]

The Step-by-Step Insurance Claim Process

Inform Insurer Immediately

File an FIR (If Necessary)

Surveyor Assessment

Repair and Settlement

Reimbursement: Get it repaired at any garage, pay the full amount, and submit the bills to the insurer for reimbursement.Cashless vs. Reimbursement: Which is Right For You?

Feature

Cashless Claim

Reimbursement Claim

Convenience

High. Insurer deals directly with the garage.

Low. You handle all payments and paperwork initially.

Upfront Cost

Minimal (only deductibles/non-covered items).

High. You must pay the entire repair bill first.

Garage Choice

Limited to insurer's network garages.

Total freedom. Choose any garage you trust.

Settlement Time

Fast. Approval happens before or during repairs.

Slow. Can take 7-15 working days after submitting all bills.

Best For

Peace of mind and minimal out-of-pocket expense.

When you prefer your trusted mechanic or are far from a network garage.

Your Personalized Decision Tool

Proactive Strategies: The Power of Add-Ons

NCB Protector

Zero Depreciation ("Bumper-to-Bumper")

Avoid These Common Claim Rejection Pitfalls

Delay in Intimation

Policy Not Active

Hiding or Faking Facts

Frequently Asked Questions

Will my premium increase after a claim, even besides losing the NCB?

What if the scratch was caused by another vehicle?

How long do I have to report the damage to my insurer?