Inheriting an apartment in Bangalore often comes with hidden financial traps. For many heirs, the financial security of property ownership vanishes when the Apartment Association hands over a maintenance invoice inflated by years of compound interest. In a recent case, a resident faced a demand for ₹2 Crores, primarily driven by an arbitrary 5.9% monthly penalty on arrears left by a negligent executor.

Housing Societies frequently operate under the assumption that their internal bylaws override national laws. They do not. This guide examines the specific legal statutes—from the Limitation Act of 1963 to the Indian Contract Act—that render such extortionate claims unenforceable. We break down the exact steps to bypass obstructionist security guards, file the correct police complaints for wrongful restraint, and use the Right to Information (RTI) to expose non-compliant committees. If you are facing harassment over legacy dues, here is the factual, legal data needed to dispute the bill and secure your property title.

Dispute Resolution Guide: Maintenance Arrears and Interest Claims

Property owners in Bangalore often face complex maintenance claims involving high penalty interest rates. This guide outlines the legal framework for challenging such invoices, addressing executor delays, and reclaiming property possession.

By Evaakil Legal Team

Updated Jan 20, 2026

Inheritance can sometimes involve complex financial liabilities. In one specific case, a Bangalore resident received a maintenance invoice of approximately ₹2 Crores. The claim involved maintenance dues accumulated over seven years, with a monthly penalty interest rate of 5.9%.

This case study analyzes the legal validity of such claims, examining the interaction between state societies acts and apartment ownership laws. It provides a strategic approach to handling executor negligence and establishing legally defensible payment structures.

Financial Analysis of the Claim

The Association’s claim utilizes a monthly interest rate of 5.9%. While this figure appears low, it annualizes to over 70%. When applied to a standard maintenance fee, the debt obligation compounds significantly over time.

Debt Trajectory: Principal vs. Interest

Comparison of actual maintenance costs versus the calculated compound interest claim over 10 years.

*Chart generated based on ₹10,000 monthly maintenance. The red line represents the Association’s calculation. The blue area represents the legal principal amount.

Legal Framework for Liability Limits

Three specific legal frameworks exist to protect property owners from excessive financial claims.

1. The Limitation Act, 1963

Under Article 113, monetary claims are typically time-barred after three years. Legally, an Association may only be able to enforce recovery of dues for the preceding 36 months. Claims prior to this period may be unenforceable in court.

2. Regulations on Interest Rates

A 5.9% monthly rate may be classified as “penal” rather than compensatory. Courts and the NCDRC often cap interest at reasonable market rates (typically 9-12% annually). Penalties deemed excessive may be challenged under Section 74 of the Contract Act.

| Feature | KSRA 1960 (Societies Act) | KAOA 1972 (Apartment Act) |

|---|---|---|

| Purpose | Clubs, Charity, Literary | Apartment Ownership & Mgmt |

| Power to Charge | Contractual (Limited) | Statutory Charge (Strong) |

| Recovery Mode | Civil Suit (Standard Process) | Recovery Certificate (Expedited) |

Judicial Precedents

Courts have established specific precedents regarding levies by Housing Societies.

Central Inland Water Transport Corpn. Ltd. v. Brojo Nath Ganguly

Supreme Court of India

Established that contracts with terms deemed “unconscionable” (such as excessive interest) entered into between parties with unequal bargaining power may be void under Section 23 of the Contract Act.

Vasant Kher vs. …

NCDRC

The National Commission has held that while maintenance dues are “recurring causes of action,” recovery is strictly limited to the period of 3 years preceding the filing of the complaint.

Invoice Analysis

Hover over the line items in this sample invoice to view potential legal discrepancies.

Executor Responsibilities & The Doctrine of Devastavit

An executor’s refusal to hand over property or pay maintenance may constitute a failure of legal duty. The beneficiary may have a valid claim against the executor’s estate.

- Section 317 (Duty to Collect): The executor is legally bound to collect the property and manage it. Failure to manage maintenance while managing rent (if applicable) is a breach of duty.

- Section 368 (Liability for Devastavit): If an executor “wastes” or “misapplies” the estate, they are personally liable to make good the loss.

Strategy: It may be argued that under Section 368, the Association should seek recovery of penal interest from the executor, as the delay resulted from their inaction.

Recovering Lost Rent (Mesne Profits)

If the executor (the aunt) rented the property but failed to pay maintenance, she may have committed Criminal Breach of Trust (IPC Section 406). The beneficiary can sue for the recovery of this rent.

Legal Concept: Mesne Profits

Under Section 2(12) of the Code of Civil Procedure (CPC), ‘Mesne Profits’ refers to the profits which the person in wrongful possession of property actually received or might with ordinary diligence have received.

Bank Statement Analysis

Request the tenant (if reachable) or the Association for records of who authorized the tenancy between 2008-2018.

Legal Notice for Accounts

Serve a notice to the executor demanding a full rendering of accounts for the rental period.

RTI Strategy for Verification

Verification of an Association’s compliance status is crucial. One can file an RTI (Right to Information) application with the Registrar of Societies to verify official filings.

Verify Legal Standing

“Please provide the certified copy of the latest ‘List of Governing Body Members’ filed by the Association for the year 2024-25.”

Purpose: To verify if the current committee is legally recognized.

Verify Interest Resolution

“Please provide a certified copy of the Resolution passed in the AGM approving a 5.9% monthly penal interest rate.”

Purpose: To confirm if the high rate was officially recorded and audited.

Protocol for Police Interaction

Law enforcement may view property disputes as civil matters. It is important to correctly frame the issue if wrongful restraint is occurring.

AVOID

“The Association is asking for too much maintenance money.”

Outcome: Likely referral to Civil Court.

PREFERRED APPROACH

“I am the legal owner (produce Khata). Access to my property is being physically obstructed. I wish to report Wrongful Restraint under IPC Section 341.”

Outcome: This identifies a potential cognizable offense requiring intervention.

Defamation & Privacy Protocol

Notice Board Publications

While Associations are generally permitted to publish lists of defaulters, the publication of disputed or grossly inflated amounts (e.g., publishing a ₹2 Crore claim when the legal liability is significantly lower) may constitute defamation under civil and criminal law (IPC Section 499).

Recommended Actions:

- Documentation: Take clear photographs of the notice board or screenshots of WhatsApp messages as evidence.

- Rebuttal: Issue a formal written objection stating the amount is “sub-judice” or “in dispute” and request its removal until adjudication.

- Legal Notice: If the harassment continues, a cease-and-desist notice for defamation can be an effective counter-measure.

Injunction Strategy (Interim Relief)

When essential services (water, electricity) are threatened or access is blocked, waiting for a final judgment is not feasible. Owners can seek immediate relief.

Temporary Injunction (CPC Order 39)

A court order restraining the Association from interfering with your possession or amenities while the main suit is pending. Courts usually grant this if you deposit the admitted principal amount.

Mandatory Injunction

A proactive order compelling the Association to restore disconnected services or remove locks immediately. This is often sought when the “status quo” has already been disturbed.

Transfer Fee Limitations

Associations often demand a percentage of the property value or a flat fee (e.g., ₹25,000 to ₹1 Lakh) as a “Transfer Fee” during inheritance or sale.

Legal Cap on Fees

Various court rulings, including those by the Karnataka High Court, have held that transfer fees should be nominal and intended only to cover administrative costs (e.g., stationery, clerical work). Demanding a percentage of the sale value or excessive amounts is typically viewed as “profiteering” and is legally indefensible.

Bylaw Compliance Checklist

Amendments to interest rates must follow statutory procedures under Section 10 of the KSRA to be valid.

1. Notice Period Verification

Was the agenda item regarding the interest rate circulated to all members 21 days prior to the AGM? Failure to do so may invalidate the resolution.

2. Registrar Filing Verification

Under KSRA Section 10(2), amendments are typically effective only upon registration. Request the “Certificate of Registration of Amendment” for the interest rate clause.

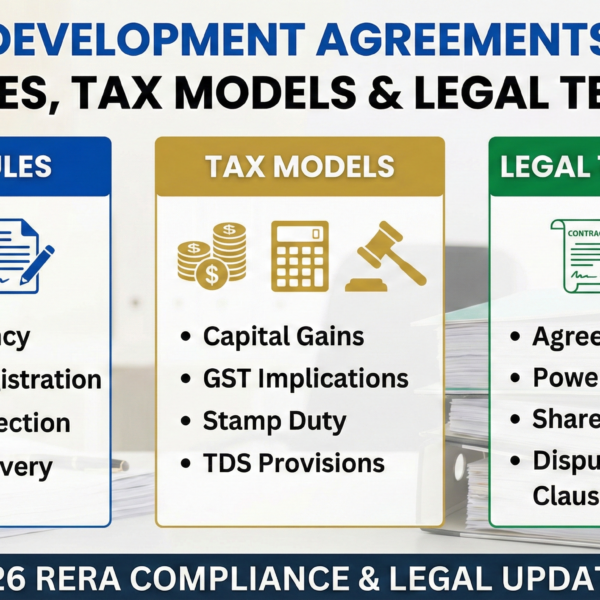

GST Applicability on Arrears

It is important to verify the correct application of GST on arrears.

Exemption Criteria

Maintenance charges up to ₹7,500 per month are generally Exempt from GST (Notification No. 12/2017). If the historical monthly maintenance was below this threshold, GST should likely not be applied to those specific arrears.

Interactive Liability Assessment

Select the parameters to estimate legal standing.

Possession & Khata Transfer Protocol

Establishing legal ownership via title deeds is the primary step before addressing Association claims.

Apply for Khata Transfer (Sakala)

Visit the local ARO (Assistant Revenue Officer) at BBMP. Required documents typically include: (a) Death Certificate, (b) Registered Will, (c) Latest Tax Paid Receipt.

Accessing the Property

Once the Khata and Encumbrance Certificate (EC) are secured, access can be established. It is advisable to have independent witnesses and video documentation. If security personnel intervene, refer to the Police Protocol.

Clarification on NOC Requirements

There is often confusion regarding the necessity of a “No Objection Certificate” (NOC) for property transfer.

COMMON MISCONCEPTION

“One cannot sell or rent an apartment without the Association’s NOC.”

LEGAL POSITION

The Karnataka High Court has observed that Associations generally lack the authority to interfere in title transfers. The Sub-Registrar typically does not require an Association NOC to register a Sale Deed.

Jurisdiction Guide: Where to File

Forum: Consumer Court / Police Station

Disconnection of essential services may be treated as a deficiency of service or a statutory offense.

Forum: Registrar of Societies

Complaints regarding financial management and bylaw violations are addressed here.

Potential Compensation Estimates

Settlement Tactic: The “Golden Bridge”

Associations often find it politically difficult to “waive” interest because other members might object. The “Golden Bridge” tactic (Sun Tzu) offers them a face-saving way to retreat.

The Tactic: “Corpus Donation” vs “Interest Payment”

Instead of paying “Penal Interest” (which admits guilt), offer a voluntary “One-time Donation to the Building Repair/Corpus Fund”.

- Why it works for You: You don’t validate the illegal interest rate. You pay a negotiated lump sum (e.g., ₹2-3 Lakhs instead of ₹2 Crores).

- Why it works for Them: The Committee can tell members, “We recovered funds for the new lift/painting,” which sounds like a victory, rather than “We lost the interest claim.”

Lok Adalat: The Fast Track

Before entering prolonged litigation in Civil or Consumer Courts, consider the Lok Adalat mechanism.

What is it?

A government-organized forum where pending or pre-litigation disputes are settled amicably in a single day. The award has the force of a civil court decree and is final (no appeal).

How to use it?

File a simple application with the District Legal Services Authority (DLSA) in Bangalore. They will summon the Association. Often, the presence of a Judge urging settlement makes Associations more reasonable.

Meeting Preparation Guide

It is advisable to be accompanied by a legal representative or witness. Maintain a professional demeanor.

You: “Resolutions must comply with statutory laws. An annual interest rate exceeding 70% may be contested legally. I am prepared to settle the Principal amount immediately. If the penalty is insisted upon, I may deposit the Principal in court and seek adjudication for Deficiency of Service.”

You: “Withholding common amenities while lawful dues are offered may constitute an Unfair Trade Practice. I am documenting this refusal and may file a formal complaint if the issue is not resolved.”

Legal Templates

Formal Response to Association

Notice to Executor

Frequently Asked Questions

Generally, no. For immovable properties situated in Karnataka, probate is not mandatory. The Registered Will can typically be used directly for Khata transfer and legal proceedings.

No. Access to water and electricity is considered a fundamental right. Even if dues are pending, an Association cannot typically act as a judicial authority to disconnect essential services. Such actions can be challenged via a Writ Petition or Police Complaint.

Some associations charge extra if a flat is vacant. In Karnataka, explicit legal provisions authorizing this in the Apartment Ownership Act are limited. Courts often look to benchmarks (like the 10% cap in Maharashtra) for reasonableness.

1. Registrar of Societies: For financial irregularities or election issues (if KSRA registered).

2. Consumer Court: For ‘Deficiency of Service’ (e.g., service disruption, billing errors).

3. Civil Court: Primarily for title disputes (can be time-consuming).