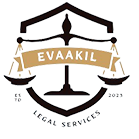

Real estate partnerships in India have shifted. The simple exchange of land for flats is now a regulated financial structure governed by strict RERA timelines and complex tax codes. Following the Finance Act 2024, the math behind Long Term Capital Gains and indexation has fundamentally altered profit margins for landowners.

This guide breaks down the operational reality of signing a Joint Development Agreement (JDA) in 2026. From structuring the General Power of Attorney to prevent fraud, to enforcing the 70% escrow rule, we examine the legal mechanics that protect your asset. Whether you are negotiating a revenue share or vetting a developer’s liquidity, these protocols ensure the deal survives from the initial MoU to the final Occupancy Certificate.

Legal Analysis • Updated Jan 2026

Joint Development Agreements in India. The 2026 Playbook.

Landowners and developers are moving beyond simple contracts to complex financial partnerships. With RERA courts piercing corporate veils and the Finance Act 2024 reshaping taxes, the rules have changed.

How Collaboration Works

The Joint Development Agreement (JDA) solves a liquidity problem. Developers avoid high-interest loans for land acquisition. Landowners unlock asset value without learning construction management.

Area Sharing

The classic barter. Landowner gets a % of built-up flats. Developer sells the rest.

Revenue Sharing

Partners share gross top-line revenue. Funds flow via escrow.

Plotted Dev

Developer lays infrastructure. Partners share plots.

JDA Deal Simulator

Compare the potential returns between taking an Area Share (Units) versus a Revenue Share (Cash).

Asset-rich. Tax deferred until CC.

Liquid cash. Risk of developer under-selling.

The Money on the Table

Beyond the sharing ratio, two critical financial levers define the deal’s liquidity for the landowner.

1. Refundable Security Deposit (RSD)

An interest-free deposit paid by the developer to the landowner upon signing. It acts as a safety net.

2. Non-Refundable Goodwill

“Signing Bonus.” Rare in current markets, but applicable for prime locations where FSI is high and land is scarce.

JDA vs. SPV (LLP)

Should you sign a JDA or form a Limited Liability Partnership (LLP) where the landowner becomes a partner? The choice impacts tax liability significantly.

The JDA Route

- ✓ Tax Deferral: Tax is paid only upon Completion Certificate (Section 45(5A)).

- ✓ Simplicity: Land title remains with the owner until individual units are sold.

- ✕ Control: Less operational control over construction quality.

The LLP (SPV) Route

- ✕ Immediate Tax: Bringing land into an LLP as capital contribution triggers immediate Capital Gains tax (Section 45(3)).

- ✓ Liability: Creates a corporate veil (though RERA often pierces this).

- ✓ Finance: Easier for banks to fund an SPV than a loose JDA.

The Approval Train

The “Time is Essence” clause in a JDA often fails because parties underestimate the regulatory sequence. You cannot skip steps.

Step 1: Title & Conversion

The 30-Year Title Search. Crucially, obtaining the Change of Land Use (CLU) order converting agricultural land to residential/commercial. (Time: 3-6 Months)

Step 2: The Master Plan

Submission of building plans to the local municipal authority (BBMP/GHMC/DDA). Obtaining Fire NOC and Airport Authority clearance. (Time: 4-8 Months)

Step 3: Environmental Clearance (EC)

Mandatory for projects > 20,000 sq meters. This is often the biggest bottleneck in Indian real estate. (Time: 6-12 Months)

Step 4: RERA Registration

Critical Threshold: No marketing or sales can occur until this RERA number is generated. (Time: 1-2 Months)

Step 5: Commencement Certificate (CC)

The formal permission to start digging. The “Time for Completion” clock starts ticking here, not at JDA signing.

Marketing Rights

Who names the building? A common friction point. Usually, the Developer retains naming rights to maintain brand consistency (e.g., “Prestige,” “Godrej”).

Cost Sharing

Revenue Share Model: Marketing costs are typically deducted from Gross Revenue before the split, or borne entirely by the developer (negotiable).

Area Share Model: Developer pays 100% of marketing for their inventory. Landowner markets their own units separately (or pays developer a fee to do it).

The NOC Trap

When a landowner sells their allocated units to a third party, developers often demand a “NOC Fee” (₹100-₹500 per sq ft) to sign the transfer papers.

Clause Fix: “The Developer shall provide NOC for sale of Landowner’s Allocation within 7 days without any transfer fee or administrative charge.”

The Power of Attorney Trap

A single omnibus General Power of Attorney (GPA) is a liability. It binds the landowner to the developer even if the project stalls. The smart strategy uses a Split-GPA Architecture.

The Split-GPA Strategy

Limited strictly to obtaining sanctions and approvals. Sign this at the start.

Authorizes developer to sell their share. Hold this in escrow until construction milestones (like plinth completion) are met.

Succession: The Legacy Shield

Real estate development spans 3-5 years. The probability of a landowner’s demise during this period is non-zero. A JDA must survive the signatory.

Mandatory Survival Clauses

The agreement must explicitly state it binds all legal heirs, executors, and administrators. It attaches to the land, not just the person.

Landowners should register a Will specifically bequeathing the “Allocated Share” in the JDA to beneficiaries to avoid probate delays.

RERA Compliance Tracker

As a landowner (and likely Co-Promoter), you must ensure the developer files mandatory updates. Use this “Watchtower” schedule.

| Frequency | Submission | What to Check |

|---|---|---|

| Quarterly | Project Updates | Number of units sold, funds collected, and physical progress photos uploaded to RERA site. |

| Annually | Form-5 (Audit) | CA Certificate certifying that 70% of funds collected were used ONLY for this project. |

| Event-Based | Project Extension | If completion date is missed, developer must apply for extension (Form-E) with valid reasons. |

Exit & Termination

Event of Default

- • Failure to obtain Commencement Certificate within 9 months.

- • Cessation of work for 90 continuous days.

- • Insolvency proceedings initiated against Developer.

- • Failure to pay refundable deposit installments.

Consequences

Revocation of GPA. The developer loses the right to sell or act on the land.

Landowner can appoint a new contractor to finish the project at the exiting developer’s risk and cost.

The 70% Escrow Rule

Under Section 4(2)(l)(D) of RERA, 70% of all collections from buyers must be deposited into a dedicated scheduled bank account.

Can only be withdrawn for construction and land costs, certified by an Engineer and CA.

Developer can use this for overheads or profit withdrawal.

Defect Liability Period (DLP)

Under Section 14(3) of RERA, the developer is liable for structural defects for 5 years after possession.

Does this cover Landowner’s Units?

Yes. If the landowner retains units for self-use or rent, the developer must service structural defects (cracks, seepage) for 5 years.

If the landowner sells the unit, this warranty transfers to the new buyer for the remaining period.

The Final Mile Protocol

Possession is not just about keys. Landowners must verify the following distinct deliverables before signing the “Possession Letter”.

Essential Handover Pack

The 2024 Indexation Shock

Tax Liability Impact: Old vs New Regime

Simulated comparison for land acquired in 2001 and developed in 2026. Data visualization only.

GST Deep Dive

| Concept | Rule / Mechanism | Impact |

|---|---|---|

| Valuation | Open Market Value | Taxed based on price charged to independent buyers. |

| Land Abatement | 1/3rd deduction | Tax is charged on 2/3rd of value (Construction Service). |

Master Agreement Structure

A standardized JDA template structure for Indian jurisdictions. Copy this skeleton to ensure all critical pillars are covered before legal review.

// PART I: THE PARTIES JOINT DEVELOPMENT AGREEMENT made at [City] on this [Date] day of [Month, Year] BETWEEN: 1. [Name of Landowner] (Hereinafter referred to as "THE OWNER") PAN: [XXXXX1234X] AND: 2. [Name of Developer Company] (Hereinafter referred to as "THE DEVELOPER") RERA Reg No: [If available] // PART II: RECITALS & GRANT WHEREAS the Owner is the absolute owner of the property described in Schedule A. WHEREAS the Developer has approached the Owner to develop a [Residential/Commercial] project. NOW THIS AGREEMENT WITNESSETH: 1. GRANT OF LICENSE: The Owner hereby grants a license to the Developer to enter upon the Schedule Property for the sole purpose of construction. This shall NOT be construed as possession under Section 53A of the Transfer of Property Act until specific milestones are met. // PART III: COMMERCIALS 2. CONSIDERATION (Area Share): a) Owner's Share: [40%] of super built-up area. b) Developer's Share: [60%] of super built-up area. c) Refundable Deposit: INR [Amount] to be paid in [3] tranches. // PART IV: TECHNICALS 3. TIMELINE: a) Plan Sanction: Within [6] months from signing. b) Completion: Within [36] months from Commencement Certificate (CC). c) Grace Period: [6] months. 4. QUALITY SPECS: Construction shall strictly adhere to specifications in Schedule B (attached). Any deviation >5% in area requires Owner consent. // PART V: LEGAL & EXIT 5. MORTGAGE RIGHTS: The Developer is entitled to raise finance ONLY on the Developer's Allocation. The Owner's Allocation must remain free from all encumbrances. 6. DELAY PENALTY: If failed to complete within Grace Period, Developer shall pay INR [Amount] per sq.ft. per month to the Owner. 7. TERMINATION: Events of Default: i) Insolvency of Developer. ii) Cessation of work for >90 days. iii) Failure to obtain CC within 12 months. 8. DISPUTE RESOLUTION: Arbitration under the Arbitration and Conciliation Act, 1996. Venue: [City]. Language: English. // SCHEDULES SCHEDULE A: Land Description (Survey No, Boundaries) SCHEDULE B: Technical Specifications (Flooring, Fixtures, Cement Brand) SCHEDULE C: Sharing Ratio Chart

Detailed FAQ

Can I cancel the JDA if the developer delays the start? ▼

Yes, but only if you have a “Time is of Essence” clause linked to specific milestones (e.g., obtaining Plan Sanction within 6 months). Without this, courts often view time as extendable. You must send a formal “Notice of Termination” citing the specific breach.

What if the developer dies or the company dissolves? ▼

If it’s a sole proprietorship, the JDA typically ends unless legal heirs are capable and willing. For companies, the JDA survives as the entity persists. Always include a “Successors and Assigns” clause to bind legal heirs/liquidators to the contract.

Is GST applicable on TDR (Transfer of Development Rights)? ▼

As of 2026, this is a litigated gray area. While the government demands 18% GST (RCM), the Supreme Court’s stay in Arham Infra suggests TDR might be “land” (exempt). The safe strategy is for the developer to pay it under protest and claim a refund later if the law settles in favor of exemption.

Can I sell my share of flats before the project is complete? ▼

Yes, but it triggers two issues: 1) You lose the Section 45(5A) tax deferral benefit, meaning Capital Gains tax becomes due immediately. 2) You become a “Promoter” under RERA for those specific units, increasing your liability.

What is the “Super Built-up Area” trap? ▼

Developers often bloat the “Super Built-up Area” (SBA) by adding excessive common spaces (loading factor) to reduce the per-sq-ft cost on paper. Ensure your sharing ratio is based on “RERA Carpet Area,” which is a defined statutory term, not the vague SBA.

The Final Word.

The era of the “handshake deal” in Indian real estate is dead. With RERA, the insolvency code (IBC), and strict tax surveillance, the Joint Development Agreement has evolved into a sophisticated financial instrument.

For Landowners, the priority is Asset Protection—insulating the land from the developer’s debt. For Developers, the priority is Clean Title—ensuring no legal ambush halts construction.

3 Rules for 2026

- 1. Never sign an irrevocable GPA without a linked Termination Clause.

- 2. Monitor RERA updates quarterly; silence is the first sign of default.

- 3. Structure your taxes before signing, not after selling.