Section 54F of the Income Tax Act offers capital gains exemption when you sell assets like shares and reinvest in a residential house. But real-life scenarios aren’t always straightforward. What if the house has multiple floors? What if it’s under your spouse’s name? Or you missed the 3-year deadline due to builder delays? With a landmark April 2025 Delhi High Court ruling on multi-storey houses and rising audit scrutiny, taxpayers and advisors alike are searching for clarity on edge cases. This article unpacks 11 low-competition, yet widely relevant questions—many still unanswered across major finance portals—and shows how you can legally structure your case for a successful 54F claim.

The Ultimate Guide to Section 54F

From construction delays to NRI complexities, we dissect the litigated and underserved angles of capital gains exemptions.

Section 54F of the Income Tax Act offers a powerful way to save tax on long-term capital gains. But beyond the simple rule of reinvesting sale proceeds into a new house lies a maze of complexities. This guide moves past the basics to explore the real-world challenges taxpayers face—and how the judiciary has interpreted the law in their favor.

We'll analyze recent case law and expert opinions to uncover strategic angles in four key areas: construction timelines, ownership structures, investment mechanics, and special scenarios. Use the interactive tabs below to navigate to the area that matters most to you.

The Construction Conundrum

The 3-year timeline for constructing a new house is the most common battleground. A rigid interpretation by tax authorities often clashes with the realities of the real estate market. Here’s how the courts have provided relief.

The 'Habitable' Standard vs. Absolute Completion

Does "constructed" mean 100% complete with a municipal certificate? The courts say no. The focus is on the investment of funds and bringing the house to a "habitable" state. Minor pending works like final flooring or paint don't disqualify you if the house is structurally complete and fit for occupation.

The legislative intent is to encourage investment in housing. If an assessee has invested the capital and the house is on the verge of completion, the benefit cannot be denied. — *Principle from B.S. Shantha kumari*

Leveraging Builder Delays: The Doctrine of Impossibility

What if you invest on time, but the builder fails to deliver within 3 years? The legal doctrine *lex non cogit ad impossibilia* (the law doesn't compel the impossible) can be your defense. Courts have consistently held that if you've done your part, you can't be penalized for delays beyond your control. But this isn't automatic—you must prove your diligence.

Proving Diligence in Builder Delays

Interactive Timeline Calculator

The deadlines for Section 54F are strict. Enter the date you sold your original asset to see your key compliance dates.

Comparison: Construction Timeline Scenarios

| Scenario | Primary Risk | Key Judicial Principle | Required Action & Documentation |

|---|---|---|---|

| 90% complete at 3-year mark; no completion certificate. | AO denies claim based on literal interpretation. | The "Habitable Standard" applies. Substantial investment and a fit-for-occupation state are sufficient. | Compile a "Habitability File": Architect's certificate, dated photos/videos, utility connections, proof of possession. |

| Builder delays possession beyond the 3-year timeline. | AO denies claim for non-compliance. | Doctrine of Impossibility protects a diligent assessee from delays beyond their control. | Build a "Diligence File": Legal notices, follow-ups, and a formal RERA complaint. |

| Investment in an under-construction flat. | AO incorrectly applies 2-year "purchase" timeline. | Booking a flat is treated as "construction," affording a 3-year timeline. | Anchor all timelines to the "allotment/agreement date." State "construction" in ITR. |

The Ownership Labyrinth

The phrase "one residential house" is simple, but its application in family and joint investment arrangements is complex. Courts have focused on beneficial ownership and functional use over strict legal titles.

Beneficial Ownership: Investment in Spouse's or Joint Name

Can you claim 54F if the new house is in your spouse's name? Yes. The judiciary has established that *beneficial ownership*, determined by the source of funds, is what matters. If you paid for the property, you can claim the exemption, regardless of the name on the title deed.

The Principle of Beneficial Ownership

Courts prioritize "substance over form." The person who provides the funds is considered the beneficial owner, making the claim valid.

Section 54F "mandates that the house should be purchased by the assessee and it does not stipulate that the house should be purchased in the name of the assessee only." — *CIT vs. Ravinder Kumar Arora*

To prove this, you need an unimpeachable paper trail: clear fund flow from your account, an affidavit from the spouse confirming no financial contribution, and loan documents in your name.

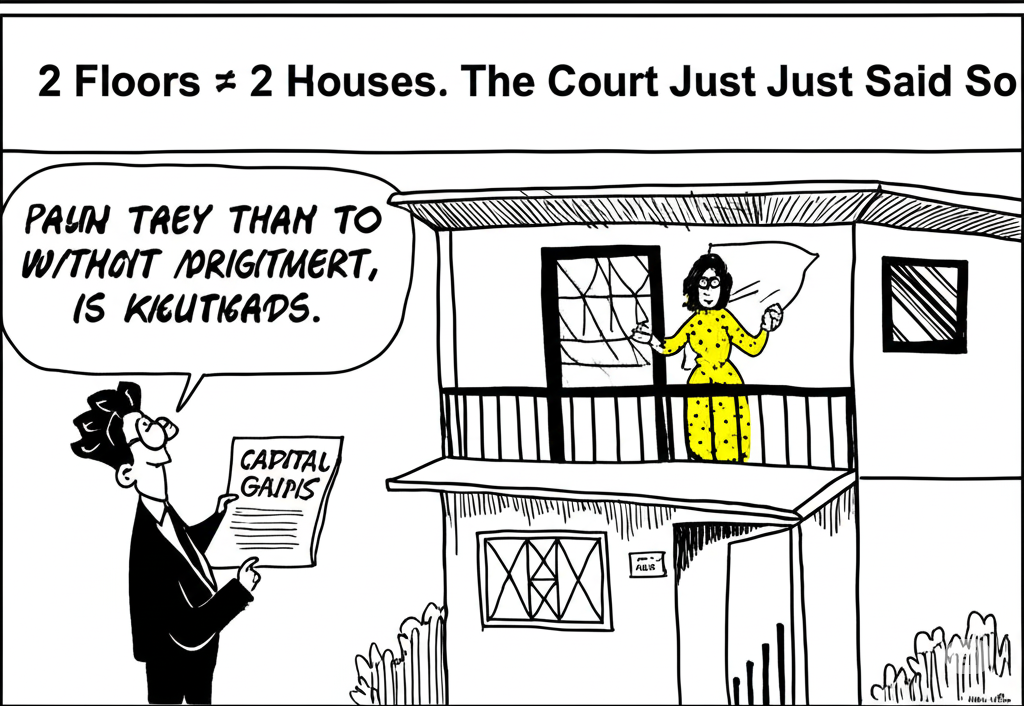

The "Single Dwelling Unit" Doctrine

What about buying two adjacent flats or multiple floors? Tax authorities may see this as buying multiple houses. However, High Courts have ruled that if the units are functionally integrated and used as a single home by the family, they qualify as "one residential house."

Functional Unity Test: What Qualifies as One House?

ALLOWED

DENIED

Ownership Risk Assessment

The viability of a claim can depend heavily on the ownership structure. This chart visualizes the litigation risk associated with common scenarios.

Advanced Investment Mechanics

How you manage your funds—from timing sales to using loans—can unlock strategic advantages. Here's how to navigate the financial mechanics of Section 54F.

The Fungibility of Funds & Loan Leverage

A common myth is that the *exact* money from the sale must be used for the new house. This is false. Courts recognize the "fungibility of money." You can use the sale proceeds for another purpose and fund the new house with a loan or other savings. What matters is that the *total investment amount* equals or exceeds the net sale consideration within the timeline.

How Fungibility of Funds Works

As long as the investment in the new house (green path) meets the required amount, the source of the specific funds used is irrelevant.

The CGAS Playbook: More Than a Parking Spot

The Capital Gains Account Scheme (CGAS) is a safe harbor if you can't invest before your ITR filing deadline. But it's also a powerful compliance tool. The structured withdrawal process (using Forms C and D) creates a perfect, auditable trail of fund utilization that can satisfy an Assessing Officer during scrutiny.

The CGAS Playbook Flowchart

The Land and Build Play

If you buy a plot and then build, the entire project is seen as "construction." The cost of land is included in your exemption claim, even if bought earlier, as long as construction finishes within 3 years of the capital gain event. This also applies to demolishing an old structure and rebuilding.

Special Scenarios & Nuances

Certain situations, like those involving NRIs or farmhouses, have specific rules and require extra care in documentation and compliance.

NRI's Guide to Section 54F

The exemption is fully available to NRIs, but the new house must be in India. The key challenge is navigating TDS (Tax Deducted at Source) and FEMA (Foreign Exchange Management Act) regulations.

NRI Compliance Pathway for Section 54F

Is a Farmhouse a "House"?

The term "residential house" isn't defined in the Act. For a farmhouse to qualify, it must pass the "residential purpose" test. The decisive factor is its intended and actual use. A property used for living, with residential features like a kitchen and bedrooms, can qualify. A property used mainly for commercial or agricultural activities will be denied.

The Farmhouse Residential Test

Qualifies as Residential

- ✔Has features like kitchen, bedrooms, bathrooms.

- ✔Primary use is for living and dwelling.

- ✔Utility bills show residential consumption.

- ✔No significant commercial activity.

Disqualifies

- ✖Only a shed or outhouse exists.

- ✖Land is primarily used for agriculture.

- ✖Used for commercial purposes (e.g., resort, events).

- ✖Not fit for human habitation.

Conclusion: Strategy, Not Loopholes

Navigating Section 54F successfully is about understanding judicial principles and meticulous documentation. The courts favor a liberal interpretation that supports the goal of housing investment. Your best defense is a proactive, well-documented claim that anticipates challenges.

Actionable Checklists

Client Onboarding Checklist

- Asset Sale: Confirm it's a long-term capital asset (other than a residential house).

- Disqualification Test: Does the client own more than one other residential house on the sale date? Investigate fractional/ancestral ownership.

- Proposed Investment: Purchase or construction? Single unit or multiple? Standard house or farmhouse?

- Ownership Structure: In whose name will the new property be registered? Who is funding it?

- Timelines: Note the ITR due date to determine the CGAS deposit deadline.

Documentation Checklist for Construction

- Registered land title deed.

- Approved municipal plans.

- Architect's certificates (progress and habitability).

- GST-compliant invoices for materials.

- Bank statements showing payments to contractors.

- Dated photographic/video log of construction stages.

Documentation for Joint/Spousal Ownership

- Unambiguous proof of fund flow from the assessee's account.

- Notarized affidavit from the spouse/joint holder confirming no financial contribution.

- Loan documents showing the assessee as the primary borrower.