Buying a home in India can be an exciting journey, but the legal complexities of Builder-Buyer Agreements (BBAs) often leave homebuyers feeling vulnerable. These crucial contracts, which outline the terms between you and a developer, frequently contain one-sided clauses that disproportionately favor the builder. At evaakil.com, we believe that understanding these pitfalls is the first step towards a secure investment. This comprehensive guide will illuminate common unfair clauses still present in Indian BBAs, detail the powerful safeguards provided by the Real Estate (Regulation and Development) Act, 2016 (RERA), and equip you with the knowledge and strategies to ensure a fair and transparent property transaction.

evaakil.com

Understanding Builder-Buyer Agreements

Builder-Buyer Agreements (BBAs) serve as the foundational legal contract between a property purchaser and a developer in India. These agreements are particularly crucial for new or under-construction properties, meticulously outlining the key terms, conditions, and mutual obligations for the real estate transaction. The BBA is a legally binding document designed to safeguard the rights and interests of both parties by establishing clear specifications for the property, detailing payment schedules, setting firm possession timelines, and defining legal remedies in case of any breaches or disputes. Its primary purpose is to ensure transparency and prevent unilateral changes by builders, thereby fostering an open and equitable relationship between the developer and the homebuyer.

The Transformative Role of RERA in Standardizing Agreements

The Real Estate (Regulation and Development) Act, 2016 (RERA), was enacted with the explicit objective of regulating and promoting the real estate sector across India. A core aim of RERA is to ensure greater transparency, efficiency, and robust consumer protection within the industry. The Act mandates the registration of real estate projects, requires comprehensive disclosure of project information, and sets forth specific guidelines for the content and format of BBAs. This legislative intervention was intended to fundamentally rebalance the power dynamics, shifting the advantage from developers towards homebuyers.

Despite RERA's clear intent and its significant impact, one-sided clauses continue to appear in Builder-Buyer Agreements. This persistence indicates that while a strong legal framework is now in place, its full implementation and the deeply ingrained practices of the real estate sector are still undergoing a transition. The continued presence of these clauses, often heavily loaded against buyers, suggests that developers may still attempt to circumvent or test the boundaries of RERA regulations. Furthermore, it highlights the ongoing vulnerability of homebuyers who may lack complete awareness of their rights or sufficient bargaining power, even under the protective umbrella of RERA. This situation underscores the ongoing need for continuous consumer education, proactive legal enforcement, and potentially further legislative refinements to ensure that the spirit of RERA is fully realized across the country.

RERA's Transformative Impact

Transparency

Mandatory project disclosures & clear BBAs.

Fund Regulation

Escrow accounts prevent fund diversion.

Consumer Protection

Faster grievance redressal & clear rights.

RERA aims to rebalance power dynamics in the real estate sector.

Judicial Scrutiny of Unfair Contracts: A Precedent-Setting Era

Indian courts, particularly the Supreme Court, have consistently acknowledged and addressed the inherent power imbalance that exists between large, sophisticated real estate developers and individual homebuyers. In many instances, homebuyers find themselves in a position where they have no viable alternative but to accept pre-drafted agreements, often referred to as "take-it-or-leave-it" contracts, compelling them to "sign on the dotted line" without meaningful negotiation. This disparity in bargaining power is a pivotal factor that prompts judicial intervention. Courts frequently strike down clauses deemed unfair or unconscionable, aligning their decisions with the fundamental principles of fairness, equity, and good conscience enshrined in the Indian Contract Act, 1872.

The Supreme Court of India has played a crucial role in reinforcing the principles of fairness and reasonableness in real estate contracts. Recent rulings have unequivocally declared that one-sided builder-buyer agreements disproportionately favoring developers are unenforceable in law. Landmark judgments, such as *Pioneer Urban Land & Infrastructure Ltd. v. Govindan Raghavan* (2019) and *Godrej Projects Development Ltd. v. Anil Karlekar & Ors.* (2025), have established strong precedents. These decisions emphasize that contractual fairness cannot be sacrificed merely for the sake of procedural formality.

Common One-Sided Clauses and Their Legal Implications

Excessive Forfeiture of Earnest Money

Builders frequently incorporate clauses in BBAs that permit them to forfeit a significant percentage, often 20% or more, of the Basic Sale Price (BSP) if a homebuyer cancels the agreement, irrespective of any actual loss incurred by the developer.

Legally, the Supreme Court has consistently ruled that the forfeiture of earnest money in builder-buyer agreements is permissible only if it is "reasonable" and does not constitute a "penalty" under Section 74 of the Indian Contract Act, 1872. The National Consumer Disputes Redressal Commission (NCDRC) and the Supreme Court have consistently capped reasonable forfeiture at 10% of the BSP, a threshold reaffirmed in numerous rulings since at least 2015. Any forfeiture exceeding this 10% threshold is considered excessive and legally unenforceable.

| Period/Authority | Typical Forfeiture Percentage in BBAs | Legally Permissible Forfeiture (as per RERA/Courts) | Key Legal Basis/Precedent |

|---|---|---|---|

| Pre-RERA Common Practice | Often 20% or more | Varied, often challenged | Contractual terms, often favoring builder |

| RERA Regulations/State Rules | N/A (RERA caps forfeiture) | Capped at 10% of BSP | Specific RERA Regulations (e.g., Haryana RERA) |

| Supreme Court Rulings (Post-RERA) | Often 20% or more (as per BBA) | Capped at 10% of BSP | Indian Contract Act, 1872 (Section 74), *Godrej Projects Development Ltd. v. Anil Karlekar & Ors.* (2025), *Pioneer Urban* (2019) |

Earnest Money Forfeiture: The Legal Limit

Typical BBA Clause

RERA/Courts Say

Any forfeiture above 10% of BSP is legally unenforceable.

Asymmetric Penalties for Project Delays

A common characteristic of one-sided BBAs is the imposition of disproportionately high interest rates on homebuyers for delayed payments (e.g., 18% per annum), while offering negligible compensation to buyers for builder delays (e.g., ₹10 per square foot per month or a mere 2% of the property value). This creates a significant imbalance in liabilities.

| Party | Typical Penalty for Delays | Legal/RERA Stance |

|---|---|---|

| Buyer (for payment delays) | 12-18% per annum | Generally enforceable if reasonable, but courts scrutinize fairness. |

| Builder (for project delays) | ₹5-10 psf/month or 2% of property value | Unenforceable; RERA mandates compensation aligned with buyer's investment (often 10-11% interest). |

Visualizing the Imbalance:

Buyer Penalty

Builder Liability

RERA aims to balance this scale, ensuring fair compensation for buyers.

Unilateral Alteration of Project Plans and Specifications

BBAs may contain clauses that purport to allow builders to change building plans, layout, or specifications without the buyer's explicit and informed consent, or with only nominal approval. This practice can lead to significant deviations from what was promised.

Section 14 of the RERA Act, 2016, specifically addresses this issue, unequivocally stating that developers cannot alter approved layout, design, or specifications without the consent of the buyers. For alterations affecting a specific apartment, prior written consent of the individual buyer is required. For changes to the overall project or common areas, the developer must obtain the prior written consent of two-thirds of all homebuyers.

Plan Alterations: Buyer's Consent is Key

Original Plan

Unauthorized Change

With 2/3rds Buyer Consent

RERA protects against arbitrary changes, requiring informed consent.

Unilateral Price Escalation Beyond Statutory Charges

Builder-Buyer Agreements might include terms that allow developers to arbitrarily increase the property price beyond what is permitted for legitimate increases in development charges or government levies. A common tactic is to tie payment schedules to a "whichever is earlier" clause, compelling buyers to pay even if construction is delayed.

RERA addresses this by mandating that the total price of the apartment should be escalation-free, with the only permissible increases being those due to development charges or other levies imposed by competent authorities. If there is any increase in taxes after the scheduled completion date, that increased amount cannot be charged from the allottee.

Price Escalation: What's Allowed?

Arbitrary Hikes (Not Allowed)

Govt. Levies/Taxes (Allowed by RERA)

RERA ensures price stability, protecting buyers from unexpected costs.

Misuse of Force Majeure Clauses

Force majeure clauses, which refer to unforeseen events or circumstances beyond a party's control, are often invoked by builders to justify project delays and avoid penalties or compensation. While RERA recognizes legitimate force majeure events, developers are strictly prohibited from misusing this clause to conceal poor project management or lack of funding.

A significant development, effective May 2025, mandates that any extensions granted by RERA under force majeure are now subject to the issuance of a public notice in prominent newspapers. This public notice explicitly invites objections from homebuyers regarding the grant of such extensions.

Force Majeure: Transparency Now Mandated

RERA Approval

Public Notice (New)

Buyer Objections

This new rule empowers buyers to challenge unjustified delays.

Hidden Charges and Unjustified Maintenance Deposits

BBAs often contain ambiguous terms or fail to disclose additional costs upfront, leading to unpleasant surprises for homebuyers. These "hidden costs" can include maintenance charges, parking fees, preferential location charges (PLC), society or clubhouse deposits, and utility connection charges.

RERA mandates strict transparency, ensuring that homebuyers are not required to pay any ad-hoc charges. All charges must be explicitly stated and clearly detailed in the allotment letter and the final sale agreement at the time of booking. Builders are legally required to open separate bank accounts specifically for depositing corpus funds and maintenance charges, which are not considered the builder's income.

Transparency in Charges: What to Expect

Allotment Letter

Explicitly Stated Charges

Separate Accounts for Deposits

RERA ensures all costs are disclosed upfront and funds are managed transparently.

Clauses Restricting Buyer's Right to Terminate

Many BBAs severely restrict a buyer's ability to terminate the agreement, even when the builder is clearly at fault, while simultaneously granting broad and often punitive termination rights to the developer. Such clauses are consistently deemed one-sided, unfair, and unreasonable by courts.

RERA provides buyers with explicit rights to withdraw from a project and claim a full refund with interest if the builder fails to provide essential information, adhere to sanctioned plans, or deliver possession on time. The Act aims to ensure that cancellation terms within BBAs are fair and balanced.

Buyer's Right to Terminate: Empowered by RERA

Unfair BBA

Courts/RERA

Full Refund with Interest

RERA ensures buyers have legitimate recourse for builder defaults.

Arbitration Clauses Attempting to Override Consumer Forum Jurisdiction

It is common for BBAs to include arbitration clauses, which attempt to compel buyers to resolve any disputes exclusively through private arbitration, thereby bypassing more accessible public forums like consumer courts or RERA authorities.

However, the Supreme Court has unequivocally clarified that an arbitration clause in a consumer agreement cannot override a consumer's fundamental right to choose a consumer forum for dispute resolution. Consumer disputes are considered "non-arbitrable" as a matter of public policy.

Dispute Resolution: Your Choice Matters

Arbitration (Builder's Preference)

Consumer Court/RERA (Your Right)

The Supreme Court upholds your right to choose public forums.

Builder's Indefinite Control Over Common Areas

BBAs may contain vague or absent clauses regarding the handover of common areas and facilities to the Apartment Owners' Association (RWA). This ambiguity allows the builder to retain control indefinitely, potentially for continued revenue generation or to avoid long-term maintenance responsibilities.

Section 17 of RERA directly addresses this issue, mandating that promoters must hand over common areas, amenities, facilities, and all necessary documents to the Apartment Owners' Association within 30 days of obtaining the Occupancy Certificate (OC), unless local laws specify a different period.

Common Areas: Timely Handover is Key

Builder Control

Handover (Post-OC)

RWA Management

RERA ensures common areas are transferred to residents' associations promptly.

RERA's Specific Safeguards and Their Effectiveness

- Mandatory Disclosures and Transparency Requirements: RERA mandates developers disclose all relevant project information on the RERA website, including approved plans, specifications, carpet area, amenities, and completion schedule. This reduces delays and combats fraud.

-

Carpet Area Adjustments and Pricing Basis: RERA mandates pricing based solely on the RERA carpet area. If carpet area decreases, buyers are entitled to a refund with interest within 45 days. If it increases, buyers pay additional costs, but capped at a maximum of 3%.

Carpet Area Adjustments Under RERA

Area Decreases

Refund + InterestArea Increases

Max 3% CostRERA ensures fair adjustments for carpet area variations.

- Regulation of Funds (Escrow Accounts) and Timely Completion: Developers must maintain a separate escrow account for each project, with a minimum of 70% of buyer funds deposited, to be used only for that project. RERA emphasizes timely completion, with penalties and compensation for delays.

- The Status of a Model Agreement for Sale: While RERA aims for standardization, the authority to create a uniform model BBA is delegated to individual states, leading to inconsistencies. A Public Interest Litigation (PIL) for a national model BBA is still underway.

Empowering Homebuyers: Strategies for Protection and Redressal

- Verify Developer Credentials and Track Record: Check RERA registration, visit past projects, and research legal disputes.

- Scrutinize Legal Compliance and Approvals: Ensure all necessary permissions (environmental, land title, CC, OC, sanctioned plans) are obtained.

- Detailed Review of BBA Clauses:

- Parties and Property Details: Verify complete and accurate information for both parties and detailed property description.

- Payment Schedule: Ensure clear total sale price, construction-linked milestones, and transparent taxes.

- Possession Timeline and Penalties: Fixed possession date with clear, reciprocal penalties for builder delays.

- Construction Specifications: Detailed specs on materials, quality, and design, with limits on builder's alteration rights.

- Hidden Charges and Maintenance: All costs explicitly stated, separate bank accounts for maintenance funds.

- Force Majeure Clause: Understand specific events, permissible extensions, and new public notice requirement.

- Cancellation and Refund Policy: Clear terms for cancellation, penalties, and timely refunds (forfeiture capped at 10% BSP).

- Dispute Resolution and Jurisdiction: Understand the method, remembering arbitration cannot override consumer forum rights.

- Indemnification Clause: Protection from financial loss due to title issues, with clear warranties.

- Common Area Rights and Handover: Buyer's share in common areas, adherence to RERA Section 17 for handover (within 30 days of OC).

- Leverage Legal Rights: Negotiate construction-linked payment terms under RERA.

- Preparation and Research: Understand market conditions, comparable values, and seller motivations.

- Clear Goals and Confidence: Define priorities and maintain a professional demeanor.

- Insist on Reciprocal Penalties: Ensure fair and balanced penalty clauses for both parties.

- Demand Transparency on Charges: Resist ambiguous terms and insist on explicit detailing of all costs.

- Be Prepared to Walk Away: Signal seriousness if fundamental terms are not met.

- Seek Professional Assistance: Engage a qualified real estate agent or legal consultant.

- Focus on Substance Beyond Price: Negotiate flexible closing dates, repairs, inclusions, and contingencies.

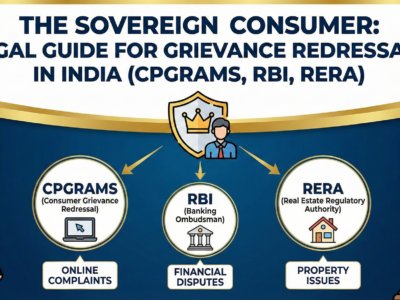

Navigating Grievance Redressal: RERA and Consumer Forums

Despite proactive measures, disputes can arise. India's legal framework provides homebuyers with clear avenues for grievance redressal.

Grievance Redressal Flowchart

Issue Arises (e.g., Delay, Defect)

Option 1: RERA Authority

For RERA-registered projects, specific RERA violations.

Option 2: Consumer Forum

For "deficiency in service," or non-RERA projects.

Gather Evidence & File Complaint (Online/Offline)

Resolution (Refund, Compensation, Rectification)

If unsatisfied, appeal to Appellate Tribunal/High Court.

Choose the appropriate forum and follow the process for redressal.

- RERA Authority: File complaints with the respective state RERA authority for RERA-registered projects or those falling under its criteria. Remedies include project completion, refunds with interest, rectification of defects, or compensation.

- Consumer Forums (Under Consumer Protection Act): File complaints for "deficiency in service" or if the project is not covered under RERA. Jurisdiction depends on claim value (District, State, or National Commission). Remedies include refunds, compensation, removal of defects, etc.

- Collective Action: Joining or forming a homebuyers' association can amplify pressure on the builder and streamline joint complaints, making legal recourse more accessible.

The Indispensable Role of Legal Counsel

Given the inherent complexities of Indian real estate law and the persistent nature of one-sided clauses in BBAs, engaging a qualified property lawyer is not merely an option but an indispensable step. A legal expert provides specialized knowledge of local regulations, stays abreast of recent case precedents, understands common developer tactics, and is familiar with regional nuances in property law. Legal counsel can offer comprehensive assistance throughout the property acquisition process, from reviewing BBAs to skillfully negotiating amendments and expertly navigating grievance redressal mechanisms.

Trending Real Estate Queries

Explore the most common questions homebuyers are searching for, highlighting key pain points and areas of concern in the Indian real estate market. Use the search box below to filter queries.