When a loved one is drowning in debt, it’s natural to want to throw them a lifeline. But taking on a personal loan in your name to help them could put your own financial future at risk. Before you sign any papers, it’s crucial to understand the legal landscape. This comprehensive guide breaks down everything from assessing the risk and drafting a legally sound family loan agreement to exploring safer alternatives and protecting your family from recovery agent harassment.

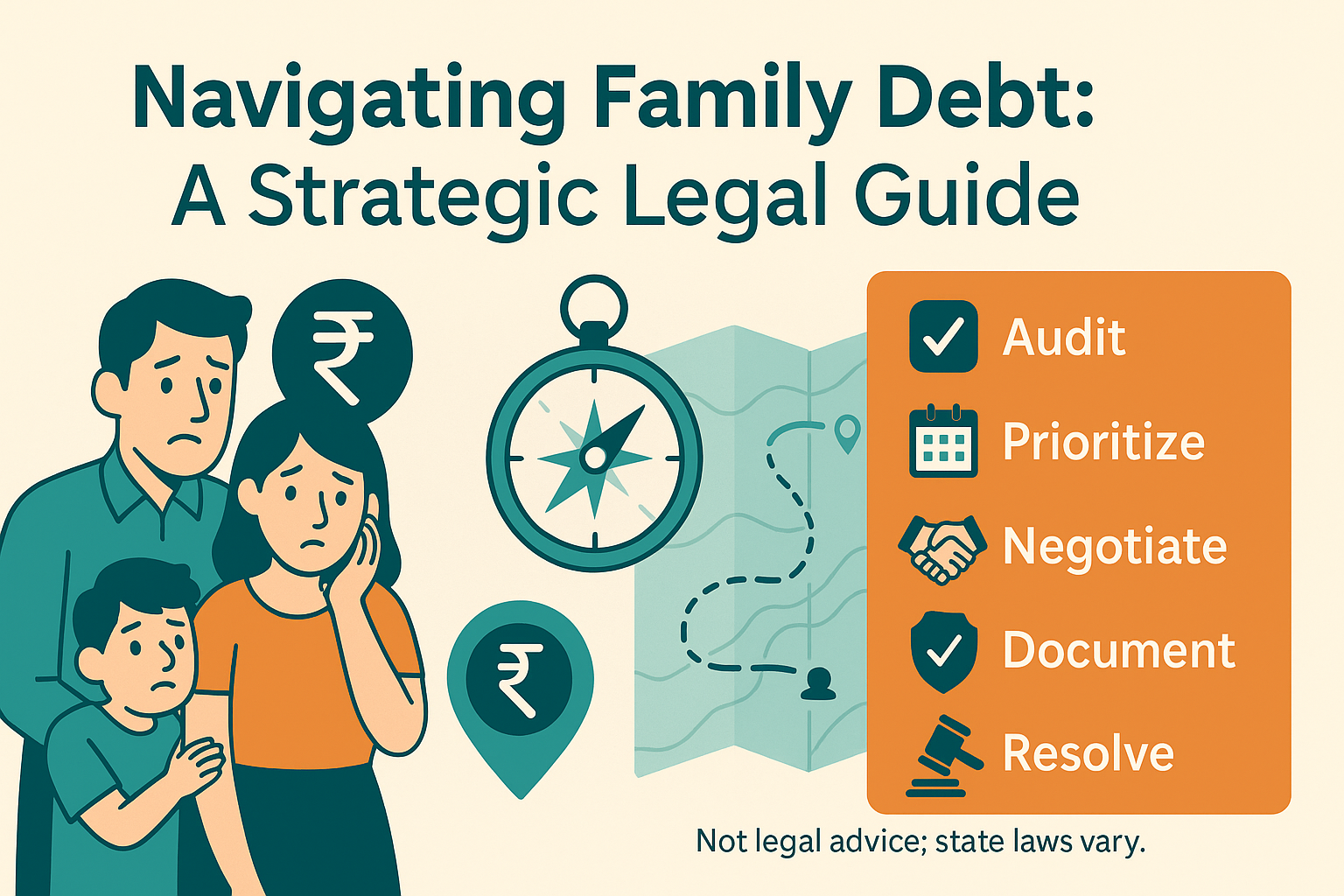

A Strategic Legal Guide to Navigating Family Debt

Before you take on a loan for a family member, understand the risks, your rights, and the safer alternatives. A comprehensive legal framework for making an informed decision.

1. Initial Strategic Assessment & Risk Analysis

Before providing financial aid, a rational, data-driven approach is essential. This is not just a family matter; it's a substantial financial transaction with profound legal consequences.

Infographic: The Critical Shift in Liability

Your Family Member's Situation (Before)

Liability spread across multiple lenders.

Debt: ₹45 Lakhs+

Your Situation (After Taking Loan)

You become the sole debtor to the bank.

Your New Debt: ₹30 Lakhs

You absorb the primary legal and financial liability. Your credit score and personal assets are now directly at risk.

Prerequisite Due Diligence

This is not about trust; it's about data. A complete financial assessment is non-negotiable.

2. Architecting a Legally Enforceable Safeguard

Transform the arrangement from an informal favor into a formal, legally binding transaction. A well-drafted Loan Agreement is your only prudent choice.

Promissory Note vs. Loan Agreement

| Feature | Promissory Note | Loan Agreement |

|---|---|---|

| Legal Basis | Negotiable Instruments Act, 1881 | Indian Contract Act, 1872 |

| Complexity | Simple, focuses on the promise to pay. | Comprehensive, allows multiple detailed clauses. |

| Inclusion of Terms | Limited to amount, interest, date. | Can include default, penalty, collateral, jurisdiction. |

| Suitability for Collateral | Not ideal; lacks a framework for securing assets. | Explicitly designed for security/collateral clauses. |

| Recommendation | Inadequate for this situation. | Essential for a loan of this size and complexity. |

3. Countering Harassment from Recovery Agents

You have rights under the RBI's "Fair Practices Code." Understand them to stop illegal harassment.

Your 5-Step Action Plan

Document Everything

Log every call, message, and visit. Note the date, time, agent's name, and a summary of the conversation. This is your evidence.

Assert Your Rights

Calmly state that you are aware of RBI guidelines, you are not liable, and all future communication must be in writing to the borrower only.

File a Formal Complaint

Email the lender's grievance redressal officer, detailing the harassment and demanding it cease. State you will escalate if ignored.

Lodge a Police Complaint (FIR)

If harassment includes threats or criminal intimidation, go to the police. This is a criminal matter.

Escalate to RBI Ombudsman

If the lender doesn't act within 30 days, file a complaint with the RBI's Banking Ombudsman. It's a free and powerful service.

4. Safer Alternatives for Debt Resolution

The proposed plan is high-risk. Explore these formal, structured mechanisms before putting your own finances on the line.

Interactive Risk Scenario Analysis

Filter the options below to compare the risk levels of different strategies.

Scenario A: You as Primary Borrower

VERY HIGH RISK- Liability: Primary & Absolute

- Credit Score Impact: Immediate & Significant

- Debt Resolution: Partial (only ₹30L)

- Recommendation: Not Advised

Scenario B: You as Guarantor

HIGH RISK- Liability: Secondary & Contingent

- Credit Score Impact: Contingent, but severe on default

- Debt Resolution: Potentially Complete

- Recommendation: A Better Alternative

Scenario C: Family Member Declares Insolvency

LOW PERSONAL RISK- Liability: None for you

- Credit Score Impact: None for you

- Debt Resolution: Complete & Final

- Recommendation: A Prudent Option

Risk Profile Comparison Chart

A visual comparison of your direct financial exposure and the impact on your credit score across the three scenarios.

5. Understanding the Tax & Legal Landscape

A formal loan agreement creates legal and tax obligations. Understanding these is crucial for protecting yourself in the long term.

Tax Implications for You (The Lender)

Structuring this as a formal loan with interest is essential for legal validity and has specific tax consequences.

Interest is Taxable Income

Any interest you receive from your family member must be declared as "Income from Other Sources" in your ITR and is taxed at your slab rate.

Principal Repayment is Not Income

The return of the principal amount is not taxed as it's a return of capital, not a profit.

Avoids "Gift Tax" Issues

A formal loan agreement proves the transaction is not a gift, which prevents potential scrutiny from tax authorities.

Legal Recourse on Default: Your Enforcement Pathway

If your family member fails to repay, your loan agreement is the key to recovering your funds. Follow this legal progression.

Step 1: Formal Written Notice

Send a formal communication via email or registered post referencing the breached clause in your agreement.

Step 2: Send a Legal Notice

Engage a lawyer to send a formal Legal Notice demanding full payment within a specified timeframe (e.g., 30 days).

Step 3: File a Civil Recovery Suit

If the notice is ignored, file a civil suit for recovery of money. A "Summary Suit" may be possible for a faster resolution.

Important: The statute of limitations for recovering a loan is **three years** from the date of the first default. You must act within this timeframe.

6. FIR Template for Harassment by Recovery Agents

When harassment from recovery agents crosses the line into criminal intimidation, threats, or abuse, filing a First Information Report (FIR) with the police is a critical step. This template can be adapted to your situation. Present this written complaint at your local police station.

Template for Police Complaint (FIR)

To,

The Officer-in-Charge,

[Your Local Police Station Name],

[City, State, Pin Code].

Date: [Date of Filing]

Subject: Filing of First Information Report (F.I.R.) against [Name of Bank/NBFC] and their recovery agents for criminal intimidation, harassment, and invasion of privacy.

Respected Sir/Madam,

I, [Your Full Name], son/daughter of [Your Father's Name], resident of [Your Full Address], wish to file this complaint against the management of [Name of Bank/NBFC] and their unidentified recovery agents who have been persistently harassing and threatening me and my family.

1. My family member, [Name of Borrower], resident of [Borrower's Address], holds a loan account with the number [Loan Account Number] from [Name of Bank/NBFC].

2. For the past [Number of days/weeks], we have been receiving incessant calls from recovery agents claiming to represent the aforementioned lender. I am not a borrower or a guarantor on this loan, yet the agents have been contacting me on my personal mobile number [Your Mobile Number].

3. The agents have used abusive and threatening language. Specifically, on the following dates and times:

- On [Date] at [Time], an agent calling from [Agent's Phone Number, if known] threatened me with [Specify the threat, e.g., "physical harm," "public humiliation," "visiting my workplace"].

- On [Date] at [Time], an agent named [Agent's Name, if known] used obscene and abusive language.

- (Add more specific instances of harassment with as much detail as possible).

4. These actions are a clear violation of the Fair Practices Code established by the Reserve Bank of India (RBI) and constitute criminal offenses under the Indian Penal Code (IPC). The constant threats have caused immense mental anguish and distress to my family.

5. I am therefore requesting you to register an F.I.R. against the responsible officials of [Name of Bank/NBFC] and their recovery agents under the relevant sections of the IPC, including but not limited to Section 503 (Criminal Intimidation) and Section 506 (Punishment for criminal intimidation).

I have attached a log of the calls and messages as evidence. I assure you of my full cooperation in the investigation.

Thank you.

Sincerely,

[Your Signature]

[Your Full Name]

[Your Mobile Number]

[Your Email Address]

7. Family Loan Agreement Template

This template provides a comprehensive starting point for a family loan agreement. It is crucial to consult with a lawyer to customize this document to your specific situation and ensure it is legally watertight.

Family Loan Agreement

**LOAN AGREEMENT**

This Loan Agreement (the "Agreement") is made and executed on this [Date] day of [Month], [Year] at [City, State].

**BETWEEN:**

**[LENDER'S FULL NAME]**

Son/Daughter of [Lender's Father's Name]

Residing at [Lender's Full Address]

PAN: [Lender's PAN Card Number]

(Hereinafter referred to as the "Lender")

**AND**

**[BORROWER'S FULL NAME]**

Son/Daughter of [Borrower's Father's Name]

Residing at [Borrower's Full Address]

PAN: [Borrower's PAN Card Number]

(Hereinafter referred to as the "Borrower")

(The Lender and the Borrower are hereinafter collectively referred to as the "Parties" and individually as a "Party")

**WHEREAS:**

A. The Borrower is in need of funds for the purpose of [Specify Purpose, e.g., consolidating existing debts, personal financial need].

B. The Lender has agreed to grant a loan to the Borrower, and the Borrower has agreed to accept the loan, subject to the terms and conditions set out in this Agreement.

**NOW, THEREFORE, IT IS HEREBY AGREED AS FOLLOWS:**

**1. LOAN AMOUNT & DISBURSEMENT**

The Lender agrees to lend to the Borrower, and the Borrower agrees to borrow from the Lender, the principal sum of ₹[Loan Amount in Numbers] (Rupees [Loan Amount in Words] only) (the "Loan"). The Loan shall be disbursed via [Mode of Transfer, e.g., RTGS/NEFT/Cheque] to the Borrower's bank account, details of which are:

Bank Name: [Borrower's Bank Name]

Account Number: [Borrower's Account Number]

IFSC Code: [Borrower's IFSC Code]

**2. INTEREST**

The Loan shall carry a simple interest at the rate of [Interest Rate]% per annum on the outstanding principal amount.

**3. REPAYMENT**

The Borrower shall repay the Loan along with interest in [Number of Installments] Equated Monthly Installments (EMIs) of ₹[EMI Amount] each. The first EMI shall be due on [Date of First EMI] and subsequent EMIs shall be due on the [Day]th day of each succeeding month until the Loan is fully repaid.

**4. SECURITY / COLLATERAL (Optional Clause)**

As security for the timely repayment of the Loan, the Borrower pledges the following assets: [Detailed description of the asset, e.g., "Gold jewelry as detailed in Annexure A"]. The Borrower warrants that they are the absolute owner of the said assets. A valuation report of the assets is attached as Annexure A.

**5. DEFAULT**

An "Event of Default" shall occur if the Borrower fails to pay any EMI on its due date. Upon an Event of Default:

a) The Lender may charge a penal interest of [Penal Interest Rate]% per annum on the overdue amount.

b) The Lender shall have the right, by giving written notice to the Borrower, to declare the entire outstanding Loan amount, along with accrued interest, immediately due and payable (Acceleration Clause).

c) The Lender shall have the right to liquidate the security/collateral to recover the outstanding dues.

**6. GOVERNING LAW AND JURISDICTION**

This Agreement shall be governed by and construed in accordance with the laws of India. The Courts in [City, State] shall have exclusive jurisdiction to adjudicate any disputes arising out of or in connection with this Agreement.

**7. ENTIRE AGREEMENT**

This Agreement constitutes the entire agreement between the Parties and supersedes all prior oral or written agreements, understandings, or arrangements.

**IN WITNESS WHEREOF,** the Parties have executed this Agreement on the date first above written.

**LENDER:**

_________________________

([LENDER'S FULL NAME])

**BORROWER:**

_________________________

([BORROWER'S FULL NAME])

**WITNESSES:**

1. _______________________

Name: [Witness 1 Name]

Address: [Witness 1 Address]

2. _______________________

Name: [Witness 2 Name]

Address: [Witness 2 Address]

---

**DISCLAIMER:** This is a template and not legal advice. It is strongly recommended to consult a qualified lawyer to draft a loan agreement specific to your needs.

8. Navigating the Emotional Toll & Family Dynamics

Financial stress is a leading cause of family conflict. A legal framework protects your finances, but open communication is needed to protect your relationship.

Preserving Relationships Amidst Financial Strain

The decision to formalize a family loan is not about a lack of trust; it's about creating clarity to prevent future misunderstandings. It separates the financial transaction from the family relationship, providing a clear path to resolution if things go wrong.

- Set Clear Boundaries: Establish from the outset that this is a business arrangement. This depersonalizes the process and protects emotions.

- Communicate Openly: Discuss the terms of the agreement openly and honestly. Ensure your family member understands their obligations and the consequences of default.

- Focus on the "Why": Frame the legal agreement as a tool to protect *everyone* involved and to ensure the family relationship can survive this financial crisis.

- Seek External Support: Encourage your family member to seek financial counseling. This demonstrates that the goal is their long-term financial health, not just a one-time bailout.

Remember, a clear contract can be the foundation that allows a family relationship to heal, rather than the issue that tears it apart.

9. Conclusive Recommendations & Actionable Checklist

Navigate this situation responsibly with a clear, phased action plan.