Online e-Stamping

Evaakil.com

Contact UsSecure, Simple, and Compliant e-Stamping

Execute rent agreements, affidavits, deeds, and more with India's safest digital stamp duty solution. Evaakil.com provides expert guidance for a fully compliant, tamper-proof, and hassle-free process.

What is e-Stamping?

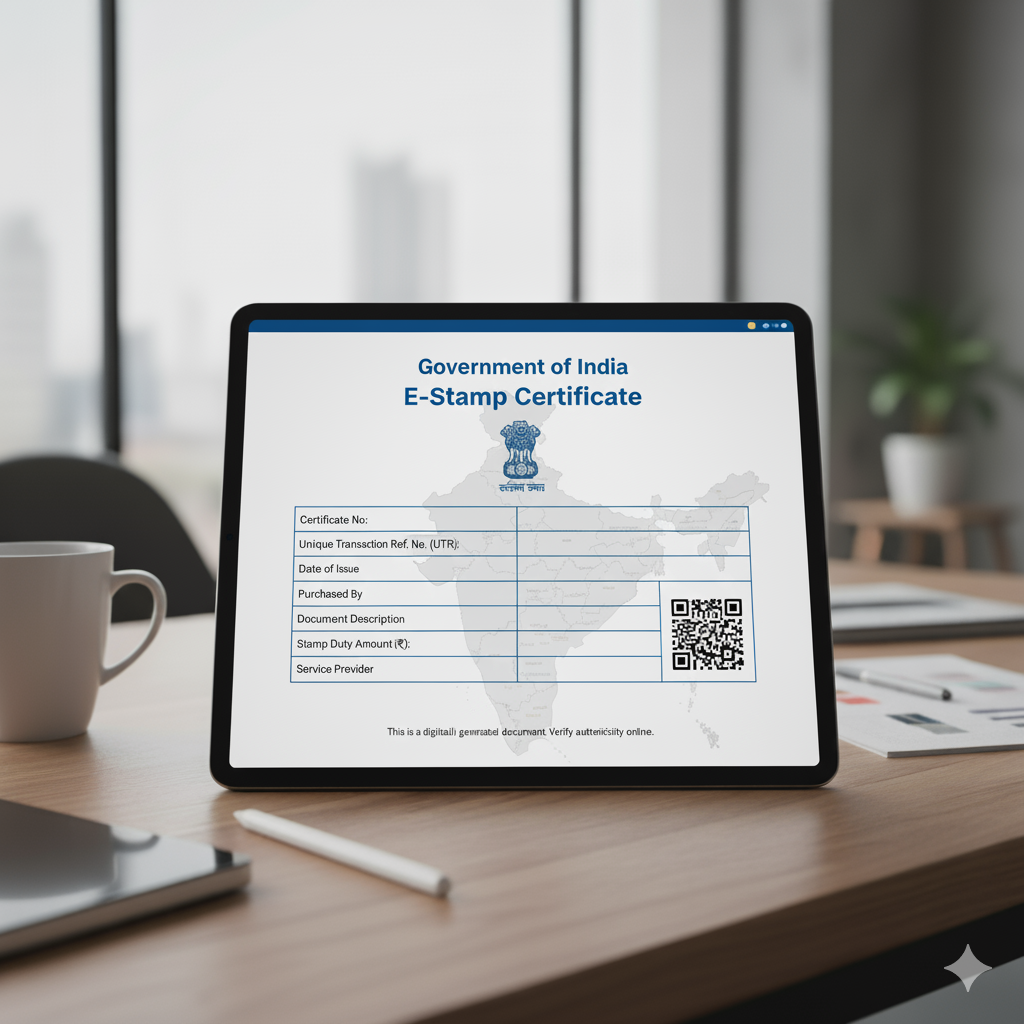

e-Stamping is the government-authorized digital method of paying stamp duty for non-judicial instruments. Instead of purchasing physical stamp paper, you receive a tamper-evident e-Stamp certificate with a Unique Identification Number (UIN). This modern approach ensures authenticity, speed, and convenience.

-

Legally Valid & Admissible

Fully compliant with the Indian Stamp Act, 1899 and recognized by courts nationwide.

-

Reduces Fraud Risk

The UIN allows for instant online verification, eliminating the risk of counterfeit stamp papers.

The Evaakil.com Advantage

We pair compliance with clarity, ensuring your documents are always legally sound.

Tailored Document Drafting

We draft documents tailored to your state’s specific stamp and registration rules.

Expert Duty Guidance

Our team helps you select the correct duty heads and verifies the e-Stamp with you before execution.

Flexible Execution Options

We structure your documents for wet-ink or e-signatures (where allowed) and guide you on registration.

Audit-Ready Bundles

Receive the final instrument, proof of duty payment, and verification trails for your records.

A Simple 4-Step Process

We've streamlined e-Stamping to save you time and ensure complete accuracy.

Tell Us Your Needs

Provide your state and instrument type (e.g., Maharashtra, Leave & License Agreement).

We Draft & Calculate

We draft the instrument with compliant clauses and compute the exact stamp duty required.

Payment & Verification

We guide you through the official payment portal and verify the e-Stamp UIN with you.

Execute & Register

We provide clear signing instructions and a checklist for registration, if required.

Documents You Can e-Stamp

We cover a wide range of non-judicial instruments for individuals and businesses.

Security & Verification: Our Top Priority

Fraudulent stamp papers can invalidate your documents. We help you stay vigilant and protected.

Best Practice: Always Verify

Never rely on screenshots or PDFs. We guide you to verify the UIN on the official SHCIL or state portal every time.

Match Particulars

Ensure the payer name, parties, consideration, and instrument description on the e-Stamp certificate perfectly match your draft.

Red Flags to Watch For

- Mismatched duty amounts or party details.

- Unverifiable UIN on the official government portal.

- Altered PDFs or unofficial payment receipts.

- Pressure from unofficial "agents" to bypass verification.

Recent police actions have exposed e-Stamp fraud. Vigilance saves time and prevents future litigation.

Frequently Asked Questions

Quick answers to common questions about e-Stamping in India.

Yes. Courts care about proper duty payment and compliance under the Indian Stamp Act. The form (paper vs. e-Stamp) is secondary to duly paid and verifiable duty.

Generally yes, unless your instrument or state mandates wet-ink signatures. India recognizes electronic signatures under the IT Act, 2000, and many modern workflows combine e-Stamping with e-Signing for fully digital execution.

This is a common myth. The Supreme Court has clarified that stamp paper does not become invalid merely because it is older than six months. What matters is correct duty payment and adherence to state rules.

Not usually “void,” but it’s inadmissible as evidence in court unless the deficient duty and any penalties are paid as per the Act. It's always better to pay the correct duty upfront.

Ready to Execute Your Documents with Confidence?

Let Evaakil.com handle the complexities of e-Stamping, drafting, and compliance. Get started with expert guidance and a transparent, fixed-fee quote.

Request a Quote