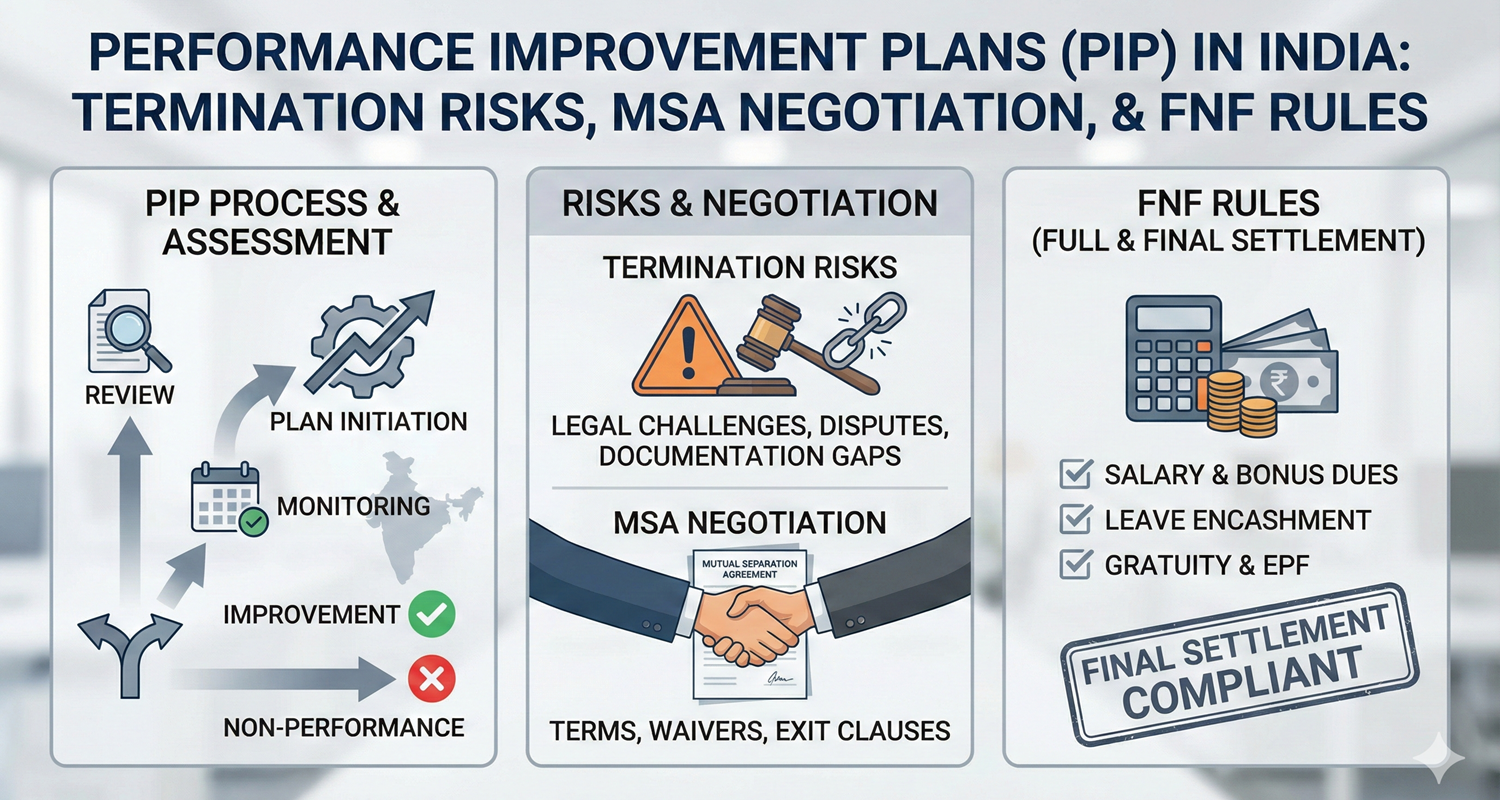

In the Indian corporate sector, a Performance Improvement Plan (PIP) functions less as a training tool and more as a legal instrument to document grounds for termination.

This document signals a shift from standard operations to a strict evidence-gathering phase. This report examines the structural reality of a 30 to 90-day PIP, the specific risks to Background Verification (BGV) history, and the financial mechanics of the Full and Final (FnF) settlement.

We analyze the enforceability of non-compete clauses, the tax implications of severance, and the legal protocols required to secure a clean exit via a Mutual Separation Agreement (MSA).

Performance Improvement Plans in India

Contents

- 1. Negative Outcomes

- 2. The PIP Timeline

- 3. Strategic Guide

- 4. The Rebuttal Strategy

- 5. The “Workman” Defense

- 6. MSA Negotiation Checklist

- 7. Clause Enforceability

- 8. Full & Final Settlement

- 9. Tax Implications

- 10. Post-Exit Logistics

- 11. Rights During Notice

- 12. Digital Exit Protocol

- 13. The Mechanics of BGV

- 14. Moonlighting During PIP

- 15. Resignation vs. Termination

- 16. Arbitration Clauses

- 17. Interview Narratives

- 18. Templates

The Performance Improvement Plan (PIP) in the Indian corporate sector formally documents an observation period. This period lasts between thirty to ninety days. Management uses this tool to create a written record. This record justifies termination and defends against wrongful dismissal claims. Employees must understand the negative outcomes, legal rights, and financial settlements involved.

1. The Negative Outcomes of a PIP

A PIP often signals the end of employment rather than a restart. The consequences of failing a PIP extend beyond immediate job loss.

Background Verification (BGV) agencies conduct checks for future employers. They contact previous Human Resources departments. If a company marks an employee as “ineligible for rehire” due to “performance issues,” this red flag appears in the BGV report. It frequently causes future employers to rescind offer letters.

Termination on grounds of performance is distinct from a layoff. A layoff implies economic reasons. Performance termination implies individual incompetence. This distinction affects the Service Certificate. A certificate stating “terminated for poor performance” damages professional reputation permanently.

PIP Outcome Statistics (2025-26)

Data indicates a high correlation between PIP initiation and eventual exit.

2. The PIP Timeline: A 60-Day Anatomy

Understanding the standard lifecycle of a PIP helps in planning the exit strategy. Most plans follow this rigid structure.

HR and Manager schedule a sudden “connect.” The PIP document is presented. Goals are often vague or unattainable.

Every minor error is documented via email. “Verbal” feedbacks stop; everything becomes written evidence.

First formal review. Usually, the feedback is “progress is visible but not enough.” This maintains pressure.

Final review. HR presents the option: Resign immediately (Mutual Separation) or face Termination.

3. Strategic Guide for Employees

Employees must act deliberately upon receiving a PIP notice. Do not react emotionally. Follow this protocol.

Documentation Protocol

Create a personal log. Forward relevant emails to a personal account if company policy permits. If not, maintain a handwritten diary with dates and times. Document every deliverable submitted. Document every delay caused by lack of resources or manager approval.

The Signature Trap

Management will request a signature on the PIP document. Signing implies acceptance of the listed deficiencies. Employees should sign with a note: “Received for review only. I do not accept the factual accuracy of these allegations.”

4. The Rebuttal Strategy

Silence is often interpreted as consent in legal proceedings. If an employee does not challenge the data presented in the PIP within 48 to 72 hours, the company can claim the employee accepted the performance gaps.

A “Rebuttal Note” or “Service Memo” is a formal document sent to HR and the Reporting Manager. It does not need to be aggressive. It must be factual. It serves two purposes: it forces HR to acknowledge a dispute exists, and it serves as evidence if the matter reaches a labor court.

5. The “Workman” Defense (Legal Deep Dive)

A critical legal distinction exists in Indian Labor Law regarding who qualifies as a “Workman” under the Industrial Disputes Act (IDA), 1947.

Are Software Engineers “Workmen”?

Recent judicial trends suggest that if an employee has no supervisory power (cannot hire/fire/approve leave), they may be classified as a workman, regardless of designation (e.g., “Senior Manager” in title only). If you fall under this category, a “performance termination” without a domestic inquiry is illegal.

6. MSA Negotiation Checklist

The Mutual Separation Agreement (MSA) is the standard exit route during a PIP. It is a contract. Like all contracts, it is negotiable. Use this checklist to ensure you cover critical grounds before signing.

7. Clause Enforceability Checker

Before exiting, verify the validity of clauses in the employment contract. Use the filters below.

| Clause | Type | Legal Status in India |

|---|---|---|

| Non-Compete | Restrictive | VOID. Section 27 of the Indian Contract Act voids post-employment restraints. Companies cannot stop you from joining a competitor. |

| Non-Solicitation | Restrictive | VALID. Courts uphold clauses that prevent you from poaching former clients or colleagues. |

| Training Bond | Financial | CONDITIONAL. Enforceable only if the company proves they spent actual money on specialized training. They cannot claim generic amounts. |

| Notice Pay Recovery | Financial | VALID. Companies can recover salary for the unserved notice period. |

| Joining Bonus Clawback | Financial | VALID. If you exit before the stipulated period (usually 1 year), the company can legally recover the joining bonus. |

8. Full and Final Settlement (FnF)

The exit process concludes with the Full and Final settlement. New regulations favor the employee.

The 2-Day Rule

Section 17 of the Code on Wages 2019 mandates that companies must pay all dues within two working days of removal, dismissal, retrenchment, or resignation. This replaces the older norms that allowed 30-45 days.

Gratuity Calculation Module

Gratuity applies after five years of continuous service. Use the calculator below to estimate your payout.

Gratuity Estimator

Formula: (15 / 26) × Basic × Years. Note: Maximum tax-free limit is ₹ 20 Lakhs (Private) / ₹ 25 Lakhs (Govt).

Leave Encashment

Earned leaves (EL) or Privilege leaves (PL) are encashable. The government increased the tax exemption limit for leave encashment to Rs 25,00,000 for non-government employees.

9. Tax Implications on Settlement

Understanding what gets taxed during the FnF settlement prevents shock when the final amount arrives.

- Gratuity: Exempt under Section 10(10) up to ₹20 Lakhs. Amounts above this are taxable.

- Leave Encashment: Exempt under Section 10(10AA) up to ₹25 Lakhs for non-govt employees (retirement/resignation).

- Notice Pay (Received): Fully taxable as “Salary.”

- Severance Pay: Generally taxable unless classified strictly as “Retrenchment Compensation” under Section 10(10B), which requires specific legal conditions to be met.

10. Post-Exit Logistics

The process is not complete until the paperwork is clean. Ensure these three steps are taken immediately after the last working day.

PF Transfer (EPFO)

Do not withdraw the Provident Fund if you plan to join another company. Withdrawal attracts tax if service is under 5 years. Transferring the PF balance preserves the service history and tax-free status.

Form 16 Issuance

Companies often delay Form 16 for exited employees. Ensure the HR team has your personal email address. You will need this document for filing Income Tax Returns in July.

UAN Service History

Log in to the EPFO portal 45 days after exit. Check the “Date of Exit” and “Reason for Exit.” Ensure the reason is marked as “Cessation (Short Service)” or “Resignation” and NOT “Termination” or “Misconduct.”

11. Rights During Notice Period

Once the resignation is submitted, the power dynamic shifts. Employees retain specific rights during this interim period.

Interview Leave

While not explicitly mandated by federal law, many state “Shops and Establishments Acts” suggest reasonable time off for seeking new employment. Employees should negotiate this in writing. If the manager denies leave, cite the need for “career continuity” to HR.

Protection from Hostile Environment

Managers often increase workload or toxic behavior during the notice period. Documenting this harassment is crucial. If the environment becomes unbearable, employees can claim “Constructive Dismissal”—a situation where they are forced to leave earlier than intended due to toxicity. This is valid grounds for legal complaint.

12. Digital Exit Protocol

Modern companies use Data Loss Prevention (DLP) tools. Missteps here can lead to legal notices for “Data Theft.”

- Clean Personal Data: Manually delete personal PDFs, images, and banking files from the laptop. Do not format the hard drive; this is considered destruction of company property.

- Browser Hygiene: Sign out of all personal Cloud accounts (Google, iCloud, Dropbox) and clear browser cache/cookies before the last day.

- Code Repositories: Never push code to a personal GitHub. Access logs are audited post-exit.

- WhatsApp/Slack: Exit work groups gracefully. Do not screenshot internal chats unless they are evidence of harassment.

13. The Mechanics of Background Verification (BGV)

Understanding how BGV agencies like AuthBridge, First Advantage, or KPMG operate is critical for risk management.

The “Red” Flag Triggers

Agencies categorize profiles as Green (Clear), Amber (Discrepancy), or Red (Critical Fail). A “Red” flag is triggered by:

- UAN Overlap: The Employee Provident Fund (EPFO) database shows dual contributions for the same month. This proves dual employment.

- Reference Negativity: The “Reporting Manager” listed in the form gives a negative review. *Strategy: List a neutral colleague or HR contact if possible, unless the form specifically demands the immediate supervisor.*

- Exit Code Mismatch: You claim “Resignation,” but the Service Certificate in the HR database says “Involuntary Termination.”

14. Moonlighting During PIP

Employees often search for new jobs or take up freelance work during the PIP or Notice Period. This carries specific legal risks.

The “Exclusive Service” Clause: Almost all employment contracts in India forbid “dual employment.” If caught, this is grounds for “Termination for Cause” (Misconduct), which denies severance pay.

The Safe Harbor: If you must work to survive: 1. Do not engage in work that conflicts with the employer’s business. 2. Ensure the secondary income is “Fee for Professional Service” (194J TDS) and not “Salary” (192 TDS). Salary generates a PF entry, which triggers the UAN overlap mentioned above.

15. Comparison Module: Resignation vs. Termination

This table clarifies the long-term impact of the two primary exit routes.

| Feature | Voluntary Resignation (MSA) | Termination (Failed PIP) |

|---|---|---|

| Service Certificate | States “Resigned” or “Service Concluded.” | May state “Terminated due to Performance.” |

| Background Check | Generally Clear (Green). | High Risk (Amber/Red). ineligible for rehire. |

| Notice Pay | Employee serves notice or pays to exit early. | Company pays notice period salary (Garden Leave). |

| Legal Recourse | Low. MSA usually includes a waiver of rights to sue. | High. Employee can approach Labor Court for wrongful termination. |

16. Arbitration Clauses

Many modern contracts include a “Mandatory Arbitration” clause. This requires disputes to be settled by a private arbitrator rather than a public court.

17. Interview Narratives

Explaining a short stint or a PIP exit to a new recruiter requires “Strategic Truth.” Do not lie, but frame the exit professionally.

“The team structure changed, and my role evolved into a direction that didn’t align with my core strengths in [Skill]. We decided to part ways mutually.”

“I was hired for [Role A], but the project requirements shifted to [Role B]. I realized I can add more value in an environment focused on [Role A].”

“I am looking for a culture that emphasizes [Value X], which I felt was missing in my previous engagement. It was a learning experience.”