Real estate brokerage in India has shifted from handwritten notes to a landscape governed by strict statutory compliance. Relying on agreement formats from the early 2000s—often simple one-pagers—now invites financial penalties and criminal liability.

With the enforcement of RERA Section 9, the PMLA notification classifying agents as “Reporting Entities,” and the new Digital Personal Data Protection (DPDP) Act, the legal ground has moved.

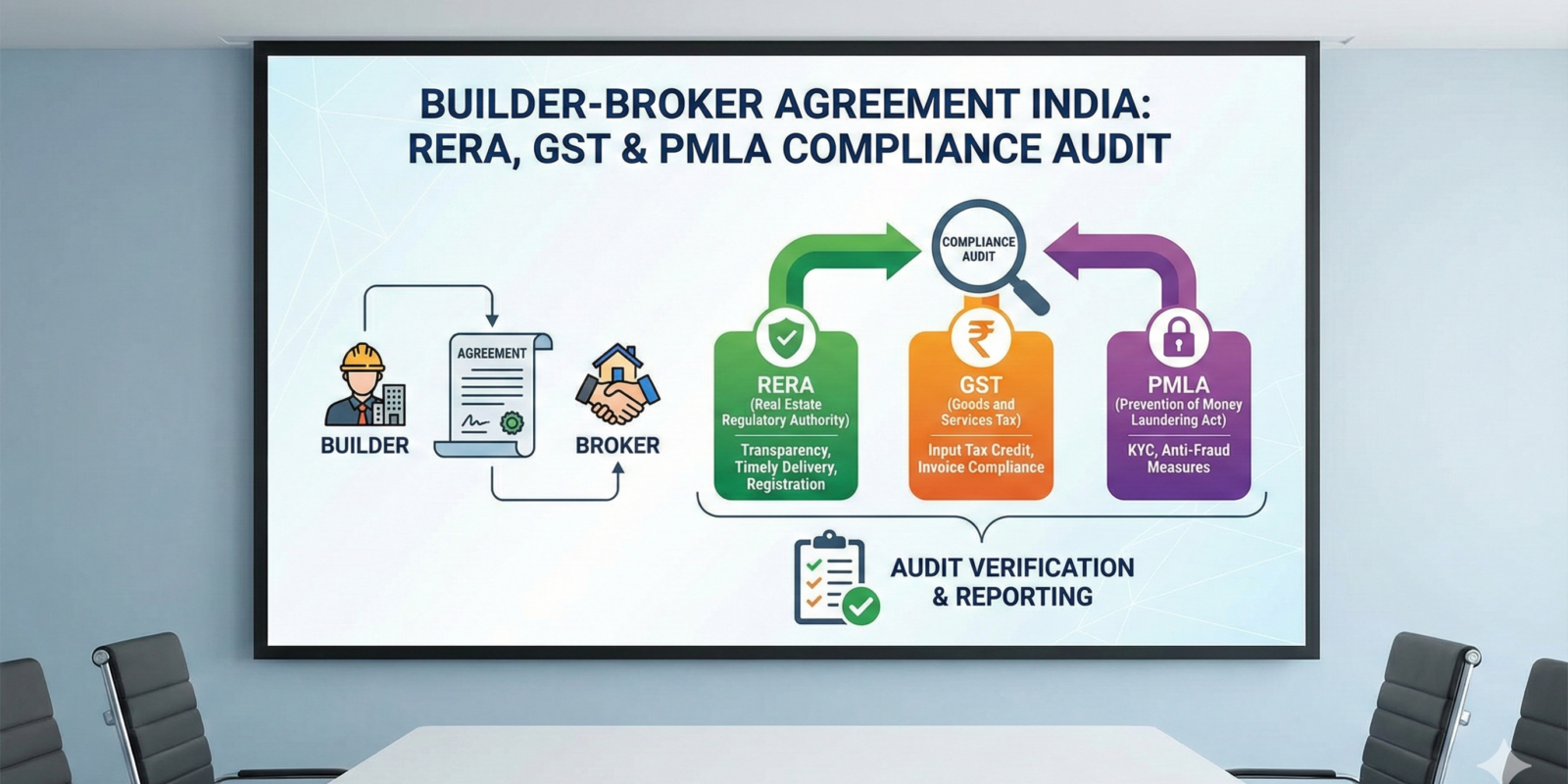

This analysis audits a standard legacy agreement against 2026 regulations, exposing hidden risks like commission clawbacks and data privacy violations, while providing a corrected, enforceable legal framework.

The Death of the Informal Broker Note. Why Your 2000-Era Agreement is a Liability in 2026.

The Indian real estate sector has moved from the Wild West of handwritten notes to a tightly regulated ecosystem governed by RERA and GST. We audited a standard “Builder-Broker Agreement” from the year 2000 against the statutory mandates of 2026. The results expose critical financial and legal vulnerabilities for both parties.

Risk Exposure Shift (2000 vs 2026)

Visualizing the shift in liability. In 2000, risk was purely financial. In 2026, it is regulatory and criminal.

The Identity Crisis: RERA Registration

The reviewed agreement identifies parties merely as “Builder” and “Broker.” In 2026, this anonymity is illegal. Section 9 of the Real Estate (Regulation and Development) Act, 2016 (RERA) mandates that no agent can facilitate a sale without a valid RERA Registration Number.

The Compliance Gap

Executing an agreement without citing the Project RERA ID and Agent RERA ID renders the contract voidable. It exposes the builder to a penalty of up to 5% of the project cost.

The Data Privacy Landmine (DPDP Act)

In 2000, brokers freely shared lists of phone numbers with builders. In 2026, sharing client data without explicit consent violates the Digital Personal Data Protection Act (DPDP Act).

When you pass a lead to a builder, you are a “Data Fiduciary.” If the builder spams that client and the client complains, YOU can be fined up to ₹250 Crores if you didn’t obtain specific consent to share data with that specific builder.

The 2026 Safeguard Clause

Add this to your agreement to shift liability:

Is a WhatsApp Mandate Valid?

The 2000-era agreement assumes physical wet-ink signatures. In 2026, brokers often rely on WhatsApp confirmations. While the Information Technology Act, 2000 recognizes electronic records, RERA tribunals are strict about “Formal Mandates.”

A mere WhatsApp chat saying “Okay, sell my flats” may not constitute a binding contract regarding commission percentage unless the specific terms were explicitly replied to with an affirmative confirmation (e.g., “Agreed to 2%”).

The Digital Protocol

- Email is King: Always follow up a chat with an email summarizing terms.

- PDF Attachment: Send the draft agreement as a PDF, not inline text.

- eSign: Use Aadhaar-based eSign services for legal admissibility.

The PMLA Radar: Brokers as “Reporting Entities”

In a massive regulatory shift, the Ministry of Finance notified Real Estate Agents as “Reporting Entities” under the Prevention of Money Laundering Act (PMLA).

This means if you facilitate a deal where you suspect the funds are illicit, or if cash transactions exceed statutory limits, you are legally bound to maintain KYC records and report suspicious transactions to FIU-IND.

Your New Duties

- KYC Mandatory: You must collect Pan/Aadhaar of the buyer *before* facilitating the booking.

- Record Keeping: Maintain transaction records for 5 years.

The “Best Quality” Trap: Marketing Liability

Clause 3 of your uploaded document states: “The builder also represents and warrants that the material used in the flats is of best quality.”

The Danger

“Best Quality” is subjective. If a broker repeats this claim in brochures, and the buyer finds the tiles sub-par, the Broker can be sued for Misleading Advertisement under the Consumer Protection Act, 2019.

The 2026 Fix

Replace vague adjectives with statutory references. The agreement must reference RERA Section 14(3) (Defect Liability Period). The Builder must indemnify the Broker against any claims arising from technical defects.

The “Direct Deal” Bypass Protocol

A common nightmare: You show a client the site. Two days later, the client returns alone and books directly with the builder to save commission or get a discount. The 2000-era agreement offers zero protection here.

How to Plug the Leak

1. The Site Visit Report (SVR)

Your agreement must mandate a digital SVR. When you visit the site, you log the client’s name and phone number in the Builder’s CRM or via email. This creates a timestamped evidence of “Effective Cause.”

2. The “Lock-in” Clause

“Any booking made by a client introduced by the Broker (evidenced by SVR) within 90 days of the site visit shall be deemed a sale facilitated by the Broker, entitling them to full commission, regardless of whether the Broker was present at the final signing.”

The “Booking” vs. “Sale” Trap

The Old Way (2000)

Commission was due upon “Booking.” A simple receipt exchange triggered a 5% payout. If the buyer cancelled later, the builder lost the commission paid.

The New Way (2026)

Commission aligns with the Agreement for Sale. Payouts happen in tranches. This protects cash flow and ensures the broker is invested in the deal’s completion.

The Dual Agency Radar

Can you charge Commission from both Builder and Buyer?

In the year 2000, “Double Dipping” (charging 2% from builder and 1% from buyer) was standard practice. In 2026, RERA Section 10 prohibits “unfair trade practices.” While dual agency isn’t explicitly illegal, it requires Full Disclosure.

Collecting fees from both sides secretly. If discovered, the Builder can forfeit your commission citing “Conflict of Interest.”

Add a disclosure clause: “The Builder acknowledges that the Broker may also receive a service fee from the Buyer for loan facilitation/documentation.”

Jurisdiction Wars: Arbitration vs. RERA

Old agreements often cited “City Civil Courts” or “Sole Arbitrator appointed by Builder.” Both are problematic today.

| Forum | Scope | Verdict |

|---|---|---|

| Civil Courts | General disputes. | Barred by RERA Section 79. Do not use. |

| RERA Tribunal | Project delays, defects, registration issues. | Mandatory for structural/project issues. |

| Arbitration | Commercial disputes (Unpaid commission). | Best for B2B payment disputes. Ensure neutral appointment. |

*Tip: Your agreement should clearly split jurisdiction: RERA for project issues, Arbitration for payment issues.

The “Clawback” Nightmare

What happens if you sell a flat, get paid, and 6 months later the buyer cancels due to financial issues? In standard builder formats, they demand a refund of the brokerage. This is the “Clawback.”

Without Protection

Builder demands 100% commission refund. You effectively worked for free and have to return spent money.

With “No Clawback” Clause

Since Builder forfeited the earnest money (10%), the Broker retains commission from that forfeited amount.

The Mathematics of Loss

Most brokers ignore the impact of TDS (u/s 194H) and GST status. Use this tool to see your actual take-home pay.

Model Agreement (2026 Ready)

We have taken the structure of your uploaded 2000-era document and rewritten it to be legally valid for 2026. This draft includes RERA compliance, GST clarity, Anti-Clawback protections, and Data Privacy clauses.

Reference: The Outdated 2000 Format (Do Not Use)

THIS AGREEMENT made at ……………… on this …………… day of …………………, 2000, between ABC Construction Co. Ltd…

1. The builder appoints the broker for selling the flats… 2. The broker will be entitled to the commission at the rate of 5 per cent on the cost of the flats booked by him.

3. The builder hereby represents… material used in the flats is of best quality. 4. The builder hereby gives the period of six- months…

Analysis: This format lacks RERA IDs, GST clauses, and specific indemnity. Using this today is a liability.

THIS AGREEMENT made at [City] on this [Day] day of [Month, Year],

BETWEEN

[BUILDER COMPANY NAME], a company incorporated under the Companies Act, 2013, having its registered office at [Address] (hereinafter called “the Promoter”), which expression shall include its successors and assigns of the ONE PART;

AND

[BROKER NAME], son of [Name], resident of [Address], holding RERA Registration No. [A5***********] (hereinafter called “the Marketing Agent”) of the OTHER PART.

WHEREAS:

A. The Promoter is developing a real estate project named “[Project Name]“ located at [Location], registered with RERA under Registration No. [P5***********] (the “Project”).

B. The Promoter is desirous of appointing a specialized agency for the marketing and sale of apartments in the said Project.

C. The Marketing Agent has represented that they are fully compliant with Section 9 and Section 10 of the Real Estate (Regulation and Development) Act, 2016.

NOW THIS AGREEMENT WITNESSES AS FOLLOWS:

- APPOINTMENT & SCOPE: The Promoter hereby appoints the Marketing Agent on a [Non-Exclusive/Exclusive] basis to facilitate the sale of apartments described in Schedule A.

-

COMMISSION & FEES:

The Promoter shall pay a commission of [X]% of the Basic Sale Price (BSP).

Note: This Commission is Exclusive of GST. GST shall be paid extra by the Promoter. TDS u/s 194H shall be deducted. -

PAYMENT MILESTONES:

- 50% upon execution of Agreement for Sale and receipt of 10% of Consideration.

- 50% upon completion of Plinth Level / Disbursement of Bank Loan.

- ANTI-CLAWBACK PROTECTION: In the event of cancellation by a Buyer introduced by the Agent, the Promoter shall NOT seek a refund of the Commission paid, provided the cancellation occurs after the forfeiture of the Booking Amount. The Agent’s services shall be deemed fully rendered upon the signing of the Agreement for Sale.

- TAIL PERIOD (SUNSET CLAUSE): If this Agreement expires, the Agent shall still be entitled to commission for any sale concluded within 12 months of expiry, provided the Buyer was introduced by the Agent during the validity period of this Agreement.

- DATA PRIVACY & INDEMNITY: The Promoter acknowledges that client data provided by the Agent is shared for the limited purpose of this Project. The Promoter agrees to adhere to the Digital Personal Data Protection Act (DPDP) and indemnifies the Agent against any misuse or unauthorized sharing of such data.

- DISPUTE RESOLUTION: Any dispute regarding Commission payment shall be referred to Arbitration in [City]. Disputes regarding Project Regulatory compliance shall be referred to the Real Estate Regulatory Authority (RERA).