When a phone call brings news of a crash, logic often disappears. You rush to the hospital, focused entirely on survival. But in India, the paperwork you ignore in those first few hours—the police statement, the medical entry, the spot map—often decides if you get financial support later or nothing at all.

The legal landscape shifted in 2026. The Indian Penal Code is out; the Bharatiya Nyaya Sanhita (BNS) is in. The PM RAHAT scheme now mandates cashless stabilization for trauma victims.

This page strips away the legal jargon. It is a direct manual on handling the police, dealing with insurance adjusters, and securing the compensation the Motor Accident Claims Tribunal (MACT) owes you. No theories, just the exact steps to take from the roadside to the bank.

Family Member Injured in an Accident? Your 2026 Legal Roadmap

A guide to medical protocols, police reporting, and securing compensation under India’s new Bhartiya Nyaya Sanhita (BNS) and the PM RAHAT scheme.

1. The First 60 Minutes (The Golden Hour)

Immediate actions dictate survival and legal success. Indian law protects Good Samaritans and mandates immediate care.

0-10 Minutes

Secure the scene. Do not move vehicles unless there is a fire risk. Capture video of vehicle positions and damage.

Emergency Calls

Dial 108 for Ambulance. Dial 112 for Police (ERSS). This creates an official timestamp.

Hospital Arrival

Declare it a Medico-Legal Case (MLC). Doctors must treat first and document later. No police clearance is needed to start treatment.

2. Critical Action Checklist

Use this interactive checklist to ensure no evidence is missed during the chaos. These items are vital for the Motor Accident Claims Tribunal (MACT).

3. Cashless Treatment: PM RAHAT Scheme

Launched fully in 2026, the PM RAHAT scheme ensures financial issues do not delay trauma care. It integrates with the e-DAR (Electronic Detailed Accident Report) system.

| Feature | Detail |

|---|---|

| Coverage Amount | Up to ₹1,50,000 per victim. |

| Validity Period | 7 days from the accident date. |

| Stabilization Window | 48 hours for life-threatening cases; 24 hours for others. |

| Funding Source | Motor Vehicle Accident Fund (MVAF). Costs are recovered from insurers or the government for hit-and-runs. |

4. The Legal Process Flowchart

Understanding the path from the accident spot to the compensation payout.

5. Decoding the Spot Panchnama

The Spot Panchnama is the document that makes or breaks your case. It is the police’s written record of the accident scene. If the map or details here are wrong, proving negligence in court becomes nearly impossible.

This rough sketch shows the position of vehicles, the victim, and road conditions.

RED FLAG: If the map shows the victim in the middle of the road (jaywalking) instead of the side (footpath), insurance companies will cut compensation by 50%.Skid marks prove the speed of the offending vehicle and the driver’s late reaction.

RED FLAG: Ensure the investigating officer measures the length of the skid marks. Absence of marks often implies the driver did not even brake.Mechanical Inspection Report helps prove the point of impact.

RED FLAG: If your vehicle has rear damage, it proves the other car hit you from behind (clear negligence). Ensure this is documented accurately.6. Criminal Action: BNS vs IPC

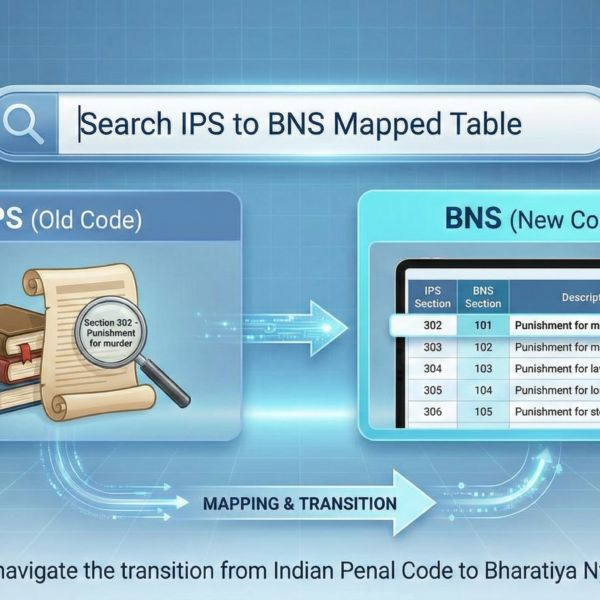

The transition from the Indian Penal Code (IPC) to the Bharatiya Nyaya Sanhita (BNS) in 2023 changed the legal definitions. Use the filter below to understand the charge.

Scenario: Reckless Driving (No Injury)

Old Law (IPC): Section 279

New Law (BNS): Section 281

Penalty: Up to 6 months jail or fine. Bailable.

Scenario: Grievous Injury (Fractures)

Old Law (IPC): Section 338

New Law (BNS): Section 338

Penalty: Up to 2 years imprisonment. Focus is on acts endangering life.

Scenario: Death by Negligence

Old Law (IPC): Section 304A

New Law (BNS): Section 106

Note: If the driver knew the act was dangerous (e.g., drunk driving), charges escalate to Culpable Homicide (Section 105).

7. Compensation Estimator (Fault vs No-Fault)

Victims must choose between “Fault Liability” (higher payout, requires proof of negligence) and “No-Fault Liability” (fixed payout, faster). The chart below visualizes the difference for a standard case involving a fatality.

*Chart values are illustrative based on the Motor Vehicles Act 1988 (Amended 2019) and standard multiplier calculations for a victim aged 40 with a stable income.

8. Why Claims Get Rejected (And How to Avoid It)

Insurance companies are for-profit entities. They will investigate these three specific areas to deny “Own Damage” or “Third Party” liability.

Delay in Intimation

Failing to inform the insurance company within 48-72 hours.

Fix: Email the insurer immediately with the vehicle number and accident spot photos, even if you are at the hospital.

Invalid Driver’s License

If the person driving (even the victim) had an expired or fake license, the claim is void.

Fix: Ensure license renewals are up to date. Verify driver credentials before hiring.

Commercial Misuse

Using a private car for commercial purposes (like a taxi) without a commercial permit.

Fix: Never accept paid passengers in a private vehicle; it voids the policy instantly.

9. Digital Tools for Investigation

Modern claims rely on digital databases. Do not wait for physical police files.

- e-DAR (Electronic Detailed Accident Report): Police upload site photos and reports here. Ask the Investigating Officer (IO) for the e-DAR reference number.

- VAHAN Portal: Use the “Know Your Vehicle Details” section to find the offending vehicle’s insurance policy status.

- IIB (Insurance Information Bureau): Verify policy validity on the date of the accident.

10. Inside the MACT Tribunal

The Motor Accident Claims Tribunal (MACT) is not a criminal court. It is a civil inquiry focused on compensation. Here is the actual timeline of a case.

| Stage | What Happens | Timeframe (Est) |

|---|---|---|

| 1. Filing Petition | You file Form I detailing the accident, age, income, and dependents of the victim. | Month 1 |

| 2. Written Statement | The Insurance Company files a reply, usually denying liability (citing license issues or negligence). | Month 3-5 |

| 3. Evidence | Crucial Step. You submit Affidavits. You must prove income (Salary Slips/ITR) and age (Aadhaar/PAN). | Month 6-12 |

| 4. Arguments | Lawyers debate the “Quantum” (Amount) based on the Sarla Verma & Pranay Sethi judgments. | Month 12-18 |

11. The Math Behind the Money

Compensation is not random; it is a formula fixed by the Supreme Court (Sarla Verma Case). You can estimate your claim using this table.

Formula: (Annual Income + Future Prospects – Personal Expenses) × Multiplier

| Victim’s Age | Multiplier |

|---|---|

| 15 to 25 Years | 18 |

| 26 to 30 Years | 17 |

| 31 to 35 Years | 16 |

| 36 to 40 Years | 15 |

| 41 to 45 Years | 14 |

| 46 to 50 Years | 13 |

| 51 to 55 Years | 11 |

| 56 to 60 Years | 9 |

Future Prospects: If the victim had a permanent job, add 50% (if under 40 years) or 30% (if over 40) to the income before calculating.

12. Lok Adalat: The Fast Track Option

If you need money urgently and cannot wait 3-4 years for a Tribunal verdict, you can opt for the Lok Adalat (People’s Court). This is a negotiation forum, not a trial.

- Speed: Cases are settled in a single day.

- Finality: No appeal is allowed against the award. The insurance company pays within 30 days.

- No Court Fees: It is cost-effective.

- Lower Amount: You typically get 20-30% less than a full trial award.

- Pressure: Insurers often pressure victims to accept lowball offers.

- No Appeal: Once you sign, you cannot ask for more money later if medical complications arise.

13. Special Case: Child Victims

Calculating compensation for minors is complex because they have no income history. The law uses “Notional Income” to determine the loss.

- Notional Income: Courts typically assume a notional income of ₹30,000 to ₹50,000 per year (adjusted for inflation) for non-earning minors.

- Loss of Future Prospects: A multiplier of 15-18 is applied.

- Pain & Suffering: Higher amounts are awarded for “Loss of Amenities of Life” if the child suffers permanent disability affecting their education or marriage prospects.

14. Permanent Disability Assessment

Injury claims depend entirely on the Disability Certificate. A simple doctor’s note is not enough; you need a certificate from a Government Medical Board.

15. The “Pay and Recover” Principle

Many families panic when they learn the offending driver had no license or was drunk. They fear the insurance company will reject the claim. Do not panic.

The Supreme Court (in Swaran Singh’s case) established the “Pay and Recover” rule. It states that for Third Party claims, the Insurance Company MUST pay the victim first. It can then recover the money from the vehicle owner. The victim does not have to chase the driver.

16. The TDS Trap (Tax on Compensation)

Is your compensation taxable? The answer lies in the split between “Principal” and “Interest”.

| Component | Tax Status | Action |

|---|---|---|

| Principal Amount | Tax-Free | This is a capital receipt (loss of life/limb). No tax is due. |

| Interest Component | Taxable | This is revenue receipt. TDS @ 10% is deducted if interest exceeds ₹50,000/year. |

Pro Tip: You can claim a refund of this TDS when filing your Income Tax Return (ITR) if your total income is below the taxable limit.

17. Digital Evidence Rules (BSA 2023)

Under the new Bharatiya Sakshya Adhiniyam (BSA), which replaced the Evidence Act, video footage (Dashcam/CCTV) is not admissible without certification.

18. Legal Heirs vs. Dependents

Not every relative gets a share of the compensation. The law distinguishes between who can file the claim and who is dependent.

- Class I Heirs: Wife, Children, and Mother are primary claimants.

- Dependency Factor: A brother or father who earns independently may be a “Legal Heir” but not a “Dependent.” They may get a share for “Loss of Estate” (savings) but not for “Loss of Dependency” (monthly income).

19. Getting Your Vehicle Back (Superdari)

If your vehicle is seized by the police, do not let it rot in the station yard. You can reclaim interim custody via a ‘Superdari’ application.

- Mechanical Inspection: Ensure the Motor Vehicle Inspector (MVI) completes the mechanical inspection report immediately. The vehicle cannot be released before this.

- File Application: Move an application before the Magistrate (or the SHO in some states) under Section 451/457 of BNSS (formerly CrPC).

- Execution of Bond: You must sign a ‘Superdaginame’ (Bond) promising not to sell, alter, or change the color of the vehicle until the trial ends.

- Photographs: Police will take photographs of the vehicle from all angles. These photos serve as primary evidence in court, allowing you to take the actual car home.

20. Contributory Negligence (How Claims Get Cut)

If the victim was also partly at fault, the compensation is reduced by that percentage. This is called “Contributory Negligence.”

Composite Negligence

Scenario: Two vehicles crash, injuring a third person (pedestrian/passenger).

Outcome: The victim can claim full money from ANY of the two drivers. No deduction.

Contributory Negligence

Scenario: Victim was not wearing a helmet or was driving on the wrong side.

Outcome: Court deducts 10% to 50% from the final award amount.

Common Deduction Rates: No Helmet (~10-15%), Triple Riding (~20%), No Seatbelt (~10%).

21. The Appeals Process

If the MACT Award is too low, you have 90 days to appeal to the High Court.

- Enhancement Appeal: Filed by the victim to increase the amount. The High Court can re-calculate income and multipliers.

- Stay Order: If the Insurance Company appeals, they must deposit 50% to 100% of the award amount with the court first. You can apply to withdraw this money immediately, even while the appeal is pending.

22. The Solatium Fund (Hit & Run Protocol)

When the enemy is invisible (Hit and Run), standard insurance claims fail. You must use the government’s Solatium Fund. This process is distinct from MACT.

- FIR is Mandatory: Police must file a “Final Report” stating the accused is untraceable.

- Claims Enquiry Officer: Submit the application to the Sub-Divisional Officer (SDO) or Tehsildar, who acts as the Claims Enquiry Officer.

- District Collector: The file moves to the District Collector for sanction.

- General Insurance Council: Once approved, the GIC transfers the funds directly to the victim’s bank account.

- Death: ₹2,00,000

- Grievous Hurt: ₹50,000

- Note: If the vehicle is found later, you can convert this into a regular MACT claim for higher amounts, adjusting the sum already received.

23. Interim Compensation (Immediate Cash)

Litigation takes years. Interim Compensation provides immediate relief without waiting for the final verdict. This is based on the principle of “No Fault Liability”.

| Type | Section (MV Act) | Details |

|---|---|---|

| No Fault Liability | Section 164 | Fixed amount: ₹5 Lakhs (Death) or ₹2.5 Lakhs (Injury). No need to prove negligence. Quick disposal. |

| Interim (Old Law) | Section 140 | Obsolete in new cases, but relevant for older pending cases. ₹50k for death, ₹25k for injury. |

Strategy: File for Section 164 Interim Relief along with your main petition. The court awards this early, and it is deducted from the final “Fault Liability” award later.

24. Hiring an Accident Lawyer (Fee Guide)

Choosing the right advocate is critical. Be aware of the fee structures to avoid exploitation.

25. The Master Document Vault

A missing document can delay your claim by months. Organize your file into these four folders immediately.

📂 Police Documents

- Certified Copy of FIR

- Spot Panchnama

- Site Map (Nazri Naksha)

- Charge Sheet (Final Report)

- MVI Report (Vehicle Inspection)

📂 Medical Documents

- MLC (Medico-Legal Certificate)

- Discharge Summary

- Original Bills (Prescriptions + Pharmacy)

- Disability Certificate (if applicable)

- Post-Mortem Report (for Death cases)

📂 Income Proofs

- Salary Slips (Last 3 months)

- Income Tax Returns (ITR – Last 3 years)

- Bank Statement (showing salary credit)

- Appointment Letter (for job security proof)

📂 Personal Proofs

- Aadhaar Card (Victim + Claimants)

- PAN Card

- Driving License (of Victim, if driving)

- School Certificate (for Age Proof)

26. Execution of Award (Getting Paid)

The judge has passed the order, but the money isn’t in your account. What now? If the Insurance Company does not pay within 30 days, interest accumulates at 12% per annum.

Step 1: File an “Execution Petition” (EP) in the same MACT court.

Step 2: The court issues a “Recovery Certificate” to the District Collector.

Step 3: The Collector recovers the amount from the Insurance Company as “Arrears of Land Revenue”.

27. Mandatory Mediation (Section 149)

The Motor Vehicles (Amendment) Act, 2019 introduced a “Settlement” option before full litigation. This is often faster.

- The Settlement Officer: A designated officer will try to broker a deal between you and the Insurance Company.

- Binding Nature: If you accept the offer, it is final. You cannot sue later. If you reject it, the normal tribunal process begins.

- Strategy: Use mediation for small injuries where the offer is reasonable. For death or permanent disability, tribunal awards are usually much higher.

28. TPA Tactics (Third Party Administrators)

Often, you aren’t dealing with the Insurance Company directly, but a TPA. They are incentivized to reduce payouts.

The “Pre-Approved” Call

TPAs may call you in the hospital offering a quick cash settlement. Decline immediately. This is often 10% of what you are actually owed.

The Blank Form

Investigators may ask you to sign blank “Discharge Vouchers” claiming it’s for hospital clearance. Signing this waives your right to future claims.

29. Loss of Consortium (Family Rights)

Compensation isn’t just for lost income. The law recognizes the emotional loss suffered by the family. In the landmark Pranay Sethi judgment, the Supreme Court standardized this.

- Spousal Consortium: ₹40,000 to the surviving husband/wife for loss of companionship.

- Parental/Filial Consortium: ₹40,000 to each child (for loss of parent) or parent (for loss of child).

- Inflation Index: This amount increases by 10% every 3 years.

30. The Fake Claim Trap (Legal Risks)

Desperation sometimes leads families to “adjust” facts—like changing the driver’s name because the real driver had no license. This is a criminal offense.

31. The “Full & Final” Settlement Trap

Insurance companies often rush to offer a cheque before you hire a lawyer. They will ask you to sign a “Discharge Voucher.”

The Trap: The voucher contains fine print saying you accept this amount as “Full and Final Settlement” and forfeit your right to claim more.

The Counter: If you accept any partial payment, always sign as “Received under Protest” or “Without Prejudice to my rights to claim further.” This keeps your legal options open.

32. Essential Templates

Copy these formats to communicate with authorities if standard procedures stall.

33. Frequently Asked Questions

The 2019 Amendment introduced a 6-month deadline (Section 166(3)). However, in November 2025, the Supreme Court stayed this provision. Currently, tribunals cannot dismiss claims solely for delay, but filing early is safer.

You cannot claim from an insurer. You must claim from the Government’s Solatium Fund. The compensation is ₹2 Lakh for death and ₹50,000 for grievous hurt. An FIR is mandatory.

Yes. However, the insurance company may argue “Contributory Negligence” to reduce the payout amount, often by 10-20%.