Introduction:

- Kolkata, with its cultural richness and economic potential, is an attractive destination for foreign nationals and expatriates looking to invest in real estate and businesses.

- Investing in a new country involves navigating legal intricacies, and foreign nationals must be aware of legal considerations to ensure a smooth and compliant investment process.

- This article provides legal tips for foreign investors seeking to invest in Kolkata, offering insights into key aspects that require attention.

Understanding Indian Laws:

- Before initiating any investment, foreign nationals must familiarize themselves with Indian laws and regulations governing investments and business operations.

- Seek legal advice to understand the legal landscape and specific requirements for foreign investors in Kolkata and India as a whole.

- Key legal areas to explore include foreign direct investment (FDI) regulations, company laws, and real estate regulations.

Legal Structures for Investments:

- Choose the appropriate legal structure for your investment, considering factors such as liability, tax implications, and ease of operations.

- Common legal structures for foreign investors in India include wholly-owned subsidiaries, joint ventures, and limited liability partnerships (LLPs).

- The legal structure should align with the nature and scale of the investment.

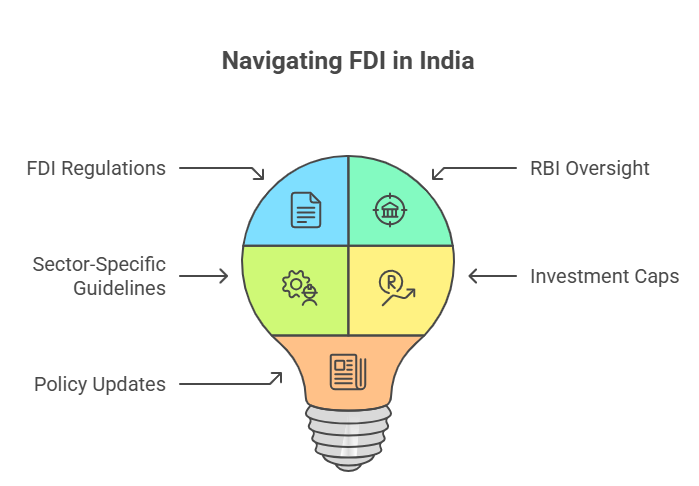

Foreign Direct Investment (FDI) Regulations:

- Be aware of FDI regulations applicable to your industry and sector.

- The Reserve Bank of India (RBI) regulates FDI in India, and investors must adhere to sector-specific guidelines and caps.

- Stay informed about any changes or updates in FDI policies that may impact your investment.

Due Diligence:

- Conduct thorough due diligence before finalizing any investment.

- Verify the legal status of the property or business, ensuring there are no legal disputes or encumbrances.

- In the case of business investments, assess the financial health, legal compliance, and reputation of the entity.

Real Estate Regulations:

- If investing in real estate, understand the specific regulations governing property transactions.

- The Real Estate (Regulation and Development) Act, 2016 (RERA) aims to protect the interests of homebuyers and promote transparency in the real estate sector.

- Verify whether the project and developer comply with RERA requirements.

Legal Documentation:

- Ensure all legal documentation is comprehensive and in compliance with Indian laws.

- Engage legal professionals to draft and review agreements, contracts, and other legal documents related to your investment.

- Pay attention to specifics, such as payment terms, dispute resolution mechanisms, and exit clauses.

Tax Implications:

- Understand the tax implications of your investment in India.

- Consult with tax professionals to determine the applicable taxes, such as income tax, capital gains tax, and Goods and Services Tax (GST).

- Be aware of any tax treaties between India and your home country that may affect your tax liability.

Compliance with Corporate Laws:

- If setting up a business entity, comply with Indian corporate laws.

- Register the business with the Ministry of Corporate Affairs (MCA) and obtain the necessary approvals and licenses.

- Appoint a company secretary and ensure compliance with annual filing requirements.

Employment Laws:

- Familiarize yourself with Indian employment laws if your investment involves hiring employees.

- Adhere to minimum wage requirements, working hours, and other labor regulations.

- Develop employment contracts that align with Indian labor laws and protect both the employer and employees.

Intellectual Property Protection:

- Protect your intellectual property rights by registering trademarks, patents, and copyrights.

- India has a robust legal framework for intellectual property protection, and registering your intellectual assets enhances legal recourse in case of infringement.

Local Partnerships and Networks:

- Establish local partnerships and networks to navigate cultural nuances and business practices.

- Engage with local legal professionals, consultants, and industry experts who can provide valuable insights.

- Building a strong local network can contribute to a smoother investment experience.

Legal Compliance for Foreign Employees:

- If employing foreign nationals, ensure compliance with visa and work permit regulations.

- Verify the eligibility criteria and documentation requirements for obtaining work visas in India.

- Keep abreast of any changes in immigration laws that may impact foreign employees.

Dispute Resolution Mechanisms:

- Include clear dispute resolution mechanisms in contracts and agreements.

- Arbitration is a common and preferred method for resolving commercial disputes in India.

- Familiarize yourself with alternative dispute resolution options available in Kolkata and India.

Environmental and Regulatory Clearances:

- Be aware of environmental regulations and obtain necessary clearances for projects that may impact the environment.

- Certain industries may require specific regulatory clearances, and compliance is essential to avoid legal complications.

Regular Legal Audits:

- Conduct regular legal audits to ensure ongoing compliance with Indian laws.

- Periodically review legal documentation, regulatory changes, and internal processes.

- Legal audits help identify and address any legal risks or non-compliance issues proactively.

Cultural Sensitivity:

- Recognize the importance of cultural sensitivity in business dealings.

- Respect local customs, traditions, and business etiquette.

- Understanding and appreciating cultural nuances contribute to positive relationships with stakeholders.

Engage Local Legal Professionals:

- Engage reputable local legal professionals with expertise in Indian laws.

- Local legal experts can provide tailored advice, navigate local regulations, and represent your interests effectively.

- Building a relationship with a trusted legal team is invaluable for foreign investors.

Conclusion:

- Investing in Kolkata as a foreign national or expatriate requires careful consideration of legal aspects to ensure compliance and success.

- Understanding Indian laws, choosing the right legal structure, and engaging local legal expertise are crucial steps.

- By prioritizing legal considerations and cultural awareness, foreign investors can navigate the legal landscape effectively and contribute to the growth of their investments in Kolkata.

What is your reaction?

Excited

0

Happy

0

In Love

0

Not Sure

0

Silly

0